Model Office’s (MO’s) aim is to ensure compliance is no longer considered as a department or business function but rather a corporate state of mind.

Model Office#RegTech and advice suitability

[fa icon="calendar'] Mar 21, 2017 9:39:20 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, mifid, HMT, suitability

#RegTech and the definition of advice

[fa icon="calendar'] Feb 28, 2017 11:32:53 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, mifid, HMT

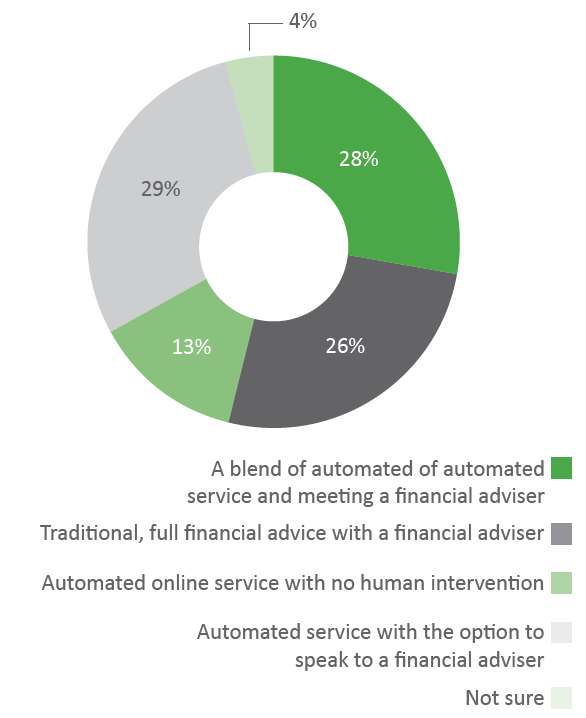

We have a new duck in town, HMT have now placed their stake in the MiFID advice definition camp and thus we now have a clear and transparent definition when advice is advice and not as the case maybe.

Benchmarking regulatory papers and good outcomes

[fa icon="calendar'] Feb 16, 2017 1:03:09 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Risk management, Soft compliance, practice management, FCA, Roboadvice, Finovate, FCA papers

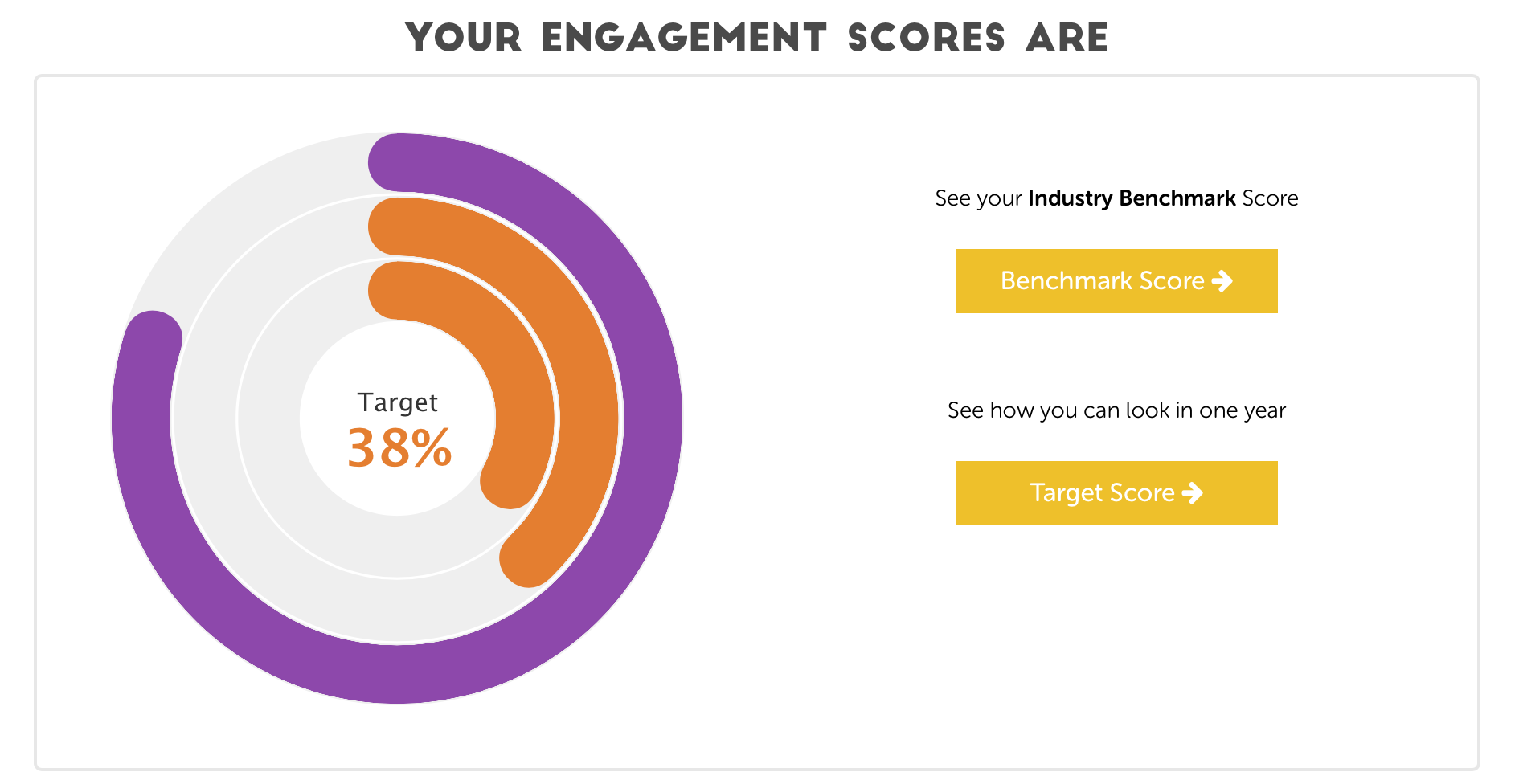

Benchmarking professional development within the retail financial service industry means calibrating the FCA directives within Model Office’s (MOs) algorithm. In our blog FCA project Innovate, regulatory resources and RegTech development we detailed some of the FCA papers that MO’s algorithm assesses and incorporates into the regulatory and business development benchmarking.

Finovate Europe 2017, Innovation, Creativity and RegTech

[fa icon="calendar'] Feb 9, 2017 11:58:37 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Risk management, Soft compliance, practice management, FCA, Roboadvice, Finovate

RegTech, RoboTech and suitability

[fa icon="calendar'] Feb 7, 2017 12:57:36 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Risk management, Soft compliance, practice management, FCA, Roboadvice

The problem with regulatory compliance and business development is it’s a bit like hurdling in the dark: you just don’t know if your strategy will protect against the constant stream of regulatory directives, compliance costs and market risks.

FCA project Innovate, regulatory resources and RegTech development

[fa icon="calendar'] Jan 31, 2017 3:54:02 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Risk management, Soft compliance, practice management, FCA

With all this creativity in play, when we were asked into the FCA to ‘kick the tires’ around the sandbox, we thought that the regulator should walk its talk and create a digital diagnostic platform that allows firms to see if they are hitting the regulatory bases and also assess how they are competing in a highly competitive market. ‘Good idea’ said the FCA, ‘But’ (there’s always a but) ‘we can’t be seen to be prescriptive’.

#RegTech and building a digital client engagement frame work

[fa icon="calendar'] Jan 10, 2017 2:50:33 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA

Model Office - MO product update #8 Algorithm v Intuition

[fa icon="calendar'] Dec 7, 2016 4:02:16 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Risk management, practice management, FCA, algorithm, intuition

With the rise of Artificial Intelligence (AI) as a marketing and sales engine for various industries and it’s potential to replace human labour, we are now entering an uncertain time for business and its people development.

Model Office - MO product update #7 MO and the gamification of compliance

[fa icon="calendar'] Dec 2, 2016 1:40:32 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Risk management, practice management, FCA

Model Office - MO product update #6 MO Selected for Finovate

[fa icon="calendar'] Nov 29, 2016 3:38:55 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Risk management, practice management, FCA

We had great news this month, MO has been selected to demonstrate it’s FinTech and RegTech features and benefits at the world's largest FinTech Expo Finovate in London February 7th – 8th 2017.