The latest FCA review of firm’s consumer duty implementation process has highlighted key concerns across a well-used regulatory tool that of proof of value (POV). Given that evidencing fair value across the Duty’s second outcome is highly subjective this was always going to be a big challenge for adviser firms.

The Consumer Duty and 7 steps to Proof of Value

[fa icon="calendar'] May 12, 2023 10:54:36 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Risk management, practice management, FCA, AI, compliance, consumer duty, artificial intelligence

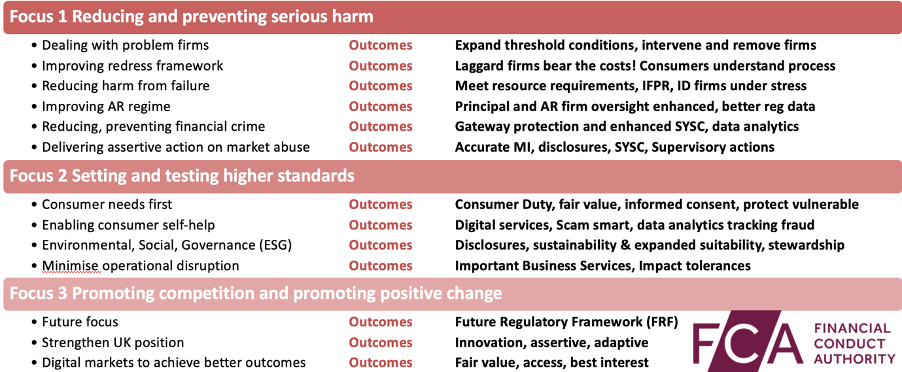

The FCA 2023 - 2024 Business plan

[fa icon="calendar'] Apr 6, 2023 3:36:54 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Risk management, practice management, FCA, AI, compliance, consumer duty, artificial intelligence

The FCA's 2023/2024 business plan outlines three key priorities: protecting consumers, ensuring market integrity, and promoting competition. Let's take a closer look at each of these priorities.

What is generative AI?

[fa icon="calendar'] Mar 8, 2023 8:47:11 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, AI, artificial intelligence

Artificial Intelligence (AI) has come a long way in the past few decades. Today, AI is capable of performing a wide range of tasks, from recognizing objects in images and translating languages to playing games and driving cars. However, one of the most exciting and rapidly developing areas of AI is generative AI, which aims to create new content, rather than simply analysing or recognising existing content.

What's all the ChatGPT about?

[fa icon="calendar'] Feb 9, 2023 9:13:32 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA

As ever with Elon Musk, he creates plenty of noise with his ventures. Whether it’s sending cars into space, letting Trump back onto Twitter, Musk sets a certain tone across industries. So it is for Artificial Intelligence with his Open AI venture which launched ChatGPT3 in November 2022.

Foreseeable Harm, the key to Consumer Duty compliance

[fa icon="calendar'] Jan 10, 2023 12:13:20 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, consumer_duty

As market participants across the distribution chain now grapple with the next deadline (30th April ’23) for product manufacturers to have clear communications and information provided to adviser (distributor) firms for them to meet the Duty obligations, they should look to one of the cross-cutting rules to help them gain context for what the regulator requires when it comes to data and information for Consumer Duty compliance.

The Consumer Duty Final Countdown

[fa icon="calendar'] Sep 30, 2022 3:10:27 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, Consumerduty

With our research showing only 1 in 4 firms taking action on the Consumer Duty and a month to go until the first October 31st deadline, it is probably worth retail advice firm’s sense checking where they are and what they need to do to ensure they have plans in place to assess their competence against this all-encompassing regulatory framework.

The Consumer Duty Final Rules and your data

[fa icon="calendar'] Jul 27, 2022 9:35:47 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, consumer duty

So, the final rules are here and not much has really changed other than the implementation period has been extended slight for live business to July 31st, 2023, and closed book business has until 31st July 2024. Plus (wait for it) firms need to be up and running on their implementation by October ’22! Although any extension is welcome, it’s not long enough in my opinion given the ramifications this all-encompassing regulatory directive brings. Think Operational Resilience which has an implementation and transitional period totalling four years!

The FCA business plan 2022/23 and your data, data, data

[fa icon="calendar'] Apr 20, 2022 10:56:00 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, FCA, Analytics

When they are not on strike, the FCA are producing promising work. Their new business plan and focus on metrics and outcomes is a case in point. This business plan takes a new form in that it is hosted digitally on a webpage which provides hyperlinks to other relevant resources such as their three-year strategy and excellent Regulatory Initiatives Grid.

Improving the Appointed Representatives Regime Consultation Paper CP21/34 and the need for #RegTech

[fa icon="calendar'] Jan 21, 2022 10:02:22 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, appointedrepresentatives

With the latest FCA consultation paper for improving regulatory oversight of the Appointed Representative Regime, without a cohesive, coordinated approach, Principle firms governance, risk and compliance (GRC) systems and control audit resources may not be deployed effectively and significant risks maybe missed. This can lead to mis communications and dysfunctions within the Principal firm internal GRC practice, poor reporting, market risk and poor consumer outcomes across AR activities. With the FCA’s new proposals, based on a background of poor consumer outcomes at the hands of ARs, Principals and their ARs now need to employ RegTech to gain clear and accurate data analytics across all activities to ensure they comply in order they can continue to compete. This blog looks at the key themes and how RegTech can support Principal firms and their ARs.

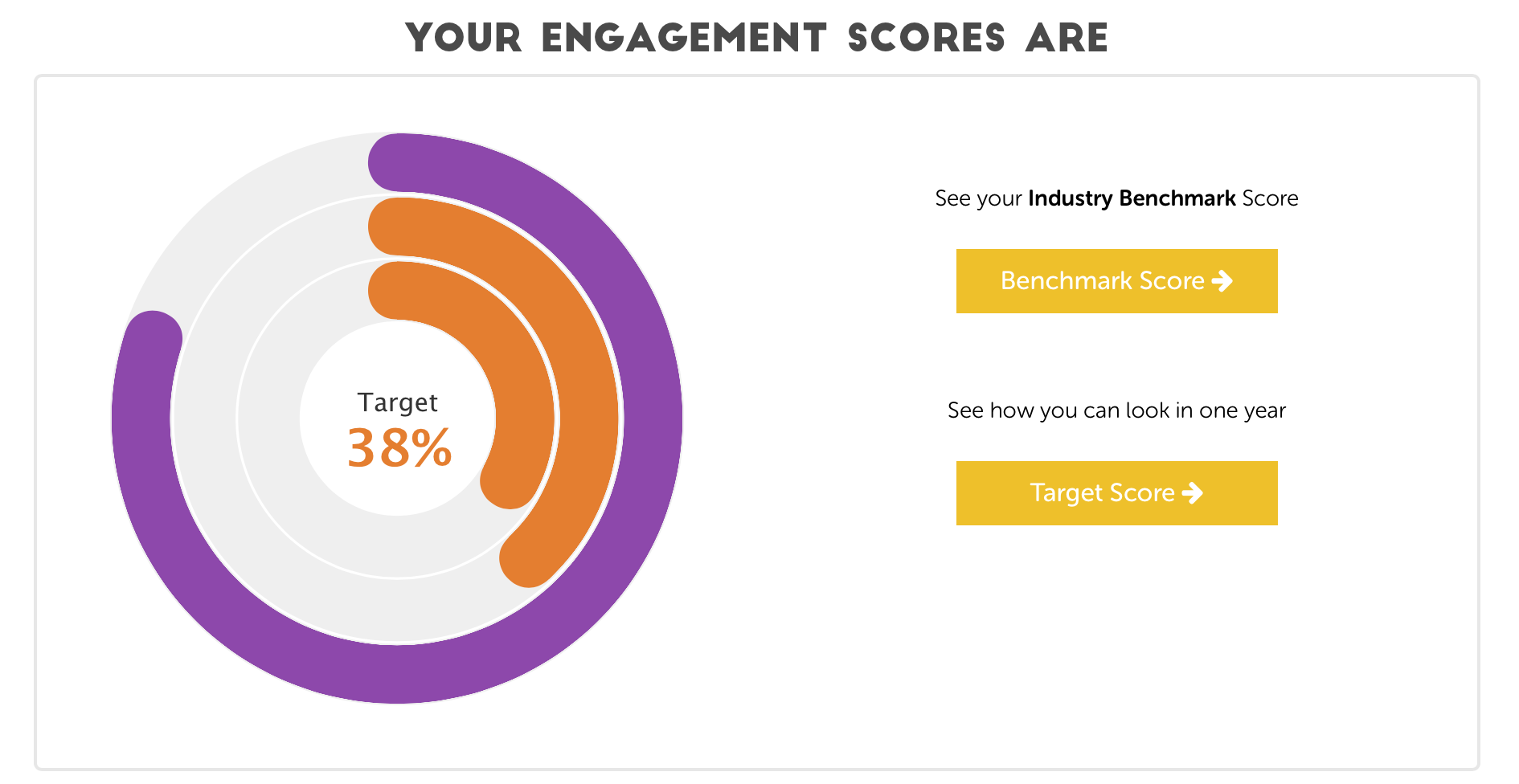

Taking Action–Model Office-MO Key 2: Your Engagement

[fa icon="calendar'] Oct 27, 2017 12:53:29 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR

In this suite of blogs we’re covering our digital compliance and business development platform Model Office (MO)’s 5 keys that form the foundations for MO’s #RegTech platform and ensures any retail investment adviser (RIA)/planner firm remain compliant, client-centric and sustainable in their professional development journey.