With nearly 300 financial advice firms telling the FCA their professional Indemnity Insurance (PII) cover for claims was non-compliant post the Financial Ombudsman Service (FOS) limit rise from £150,000 to £350,000 and reports of 300%+ increases in PII premiums post FCA DB pension transfer directives means the industry is now facing a real dilemma.

The hard PII market we now find ourselves in is placing huge pressure on firm’s margins and a significant threat when you consider the FCA’s Financial Advice Market Review estimated that direct (fees and levies) and indirect (staff/support) compliance costs are around 11% of turnover. Of this, 3% is spent on direct fees and levies, 8% on employing internal compliance staff/external compliance support.

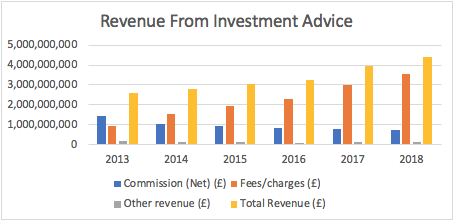

There is good news, the FCA’s Retail Mediation Activities Return (RMAR) 2018 analysis depicts a market on the up in the sense that revenues are increasing significantly as can be seen by the below chart.

Table 1. Total revenue earned from retail investment business

When it comes to PII we can see below the % of premiums of regulated revenues.

Table 2. PII premiums

|

Revenue band |

Total annualised PII premium (£) |

Average PII premium per firm (£) |

Average regulated revenue per firm (£) |

PII premium as % of regulated revenue |

|

Up to £100k revenue |

£2,219,827 |

£2,347 |

£58,493 |

4.0% |

|

£101k to £500k revenue |

£12,779,732 |

£5,528 |

£251,748 |

2.2% |

|

£501k to £10m revenue |

£53,639,576 |

£38,617 |

£1,346,492 |

2.9% |

|

Over £10m revenue |

£25,807,800 |

£860,260 |

£74,428,551 |

1.2% |

|

All firms |

£94,446,935 |

£20,194 |

£1,013,579 |

2.0% |

As with any statistics we need to ensure due diligence and scrutiny is in place to ensure as fair a picture as possible. What we don’t see in the above information is how business owners are taking their income, how tax will play its part and the true full cost of compliance and its effect on fees. If you believe the FCAs data bulletins, then the total cost of compliance is around £500M based on last years stats. That’s a large sum to swallow.

So, what can be done?

Its important firms don’t take their eyes of the prize of providing quality and much need financial adviser and planning services to their clients. What firms can then do is ensure they have:

1. The right team: Diversifying the board and administration team will ensure firms have the right people in place to bring challenge, risk management and efficient service to meet stakeholder needs such as clients and the regulator

2. Apply technology: RegTech can help ensure the firm knows where the compliance blind spots and weaknesses are so they can take immediate action and know they comply and can continue to compete. Streamlining business operations and regulatory reports will provide instant Management Information (MI) clean data and save time and costs associated with traditional check list/tick box swivel chair compliance activity (disparate sources e.g. spreadsheets) Practice management technology will also help ensure firms streamline business and compliance management activities and ensure compliant and effective advice services are supported

3. Educate the PII underwriters on firm risk: The problem is that PII underwriters set risk on the market as a whole, this is unfair on the majority of firms who operate a professional practice, so by employing RegTech, firms can showcase evidence they are a good risk and potentially place a hard stop on market risk assessment and turn the emphasis on firm risks instead

At the end of the day, evidence-based practice is now crucial for firms to showcase they are managing risks, highly compliant and operate a constructive culture. PII underwriters will benefit greatly if they can gain tangible evidence on a firm’s good risk status which should then place a downward pressure on the continued rise in PII premiums.

Please click the below icon link to MO®'s #RegTech platform and learn more about MO® today..