With the FCA stipulating that advice boundary review (along with the Consumer Duty) is its top priority for 2024, firm’s should now engage how tech can enable streamlined advice and support the mass unadvised. The FCA Discussion Paper 23/5 delves into the nuanced boundary between financial advice and guidance, raising pertinent questions about the application of artificial intelligence (AI) in navigating this complex terrain.

The FCA Advice Boundary and AI

[fa icon="calendar'] Apr 23, 2024 4:04:50 PM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, boundary

5 Regulatory challenges for 2022 and how RegTech can help

[fa icon="calendar'] Jan 5, 2022 3:45:00 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, MiFIDII, Data, GDPR, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice, GRC, governance, compliance, ESG, appointed representative, consumer duty

As we enter a new year, it provides us with an opportunity to review the past years activities and look ahead at what is to come. Indeed January is named after the Roman god Janus, who had two faces so he could see the past and future. What Janus may have told us from a regulatory perxpective.is the FCA are 'one one' with their future vision and learning from the past when it comes to firms regulation data and compliance analytics.

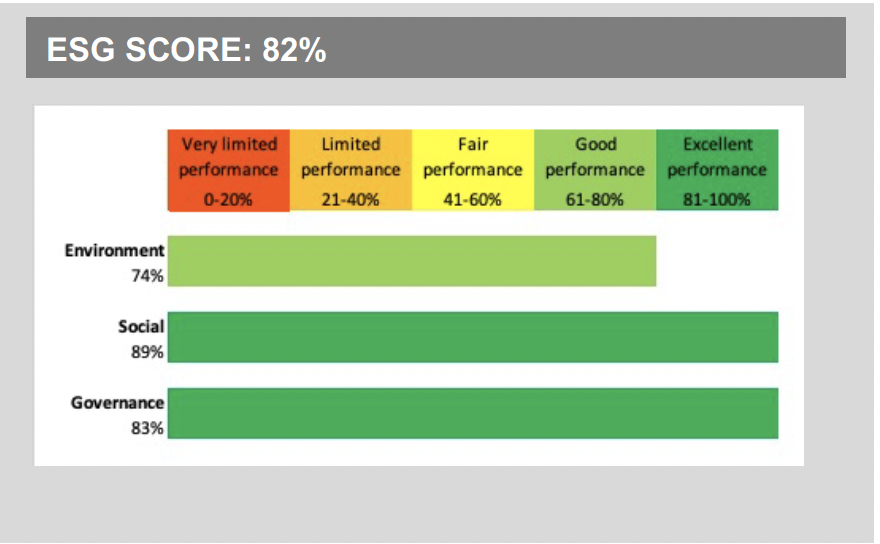

ESG: A green light for going green

[fa icon="calendar'] Nov 11, 2021 4:22:50 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, MiFIDII, Data, GDPR, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice, GRC, governance, compliance, ESG

The ongoing focus on Environmental, Social and Governance (ESG) investment highlights the financial services industry's ongoing instrumental role in the transition to net-zero, through its ability to mobilise capital and engage with investors, companies and citizens.

Does Artificial Intelligence (AI) really exist in retail financial services? Discuss

[fa icon="calendar'] Sep 17, 2021 9:17:49 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, Data, GDPR, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice, AI, GRC, governance, compliance

This is a topic that often comes up across social media and conferences that focus on FinTech developments within retail financial services industry. There is no doubt with the fast growing digital ‘fourth revolution’, we are witnessing rapid build and deployment of tech throughout industry products and services.

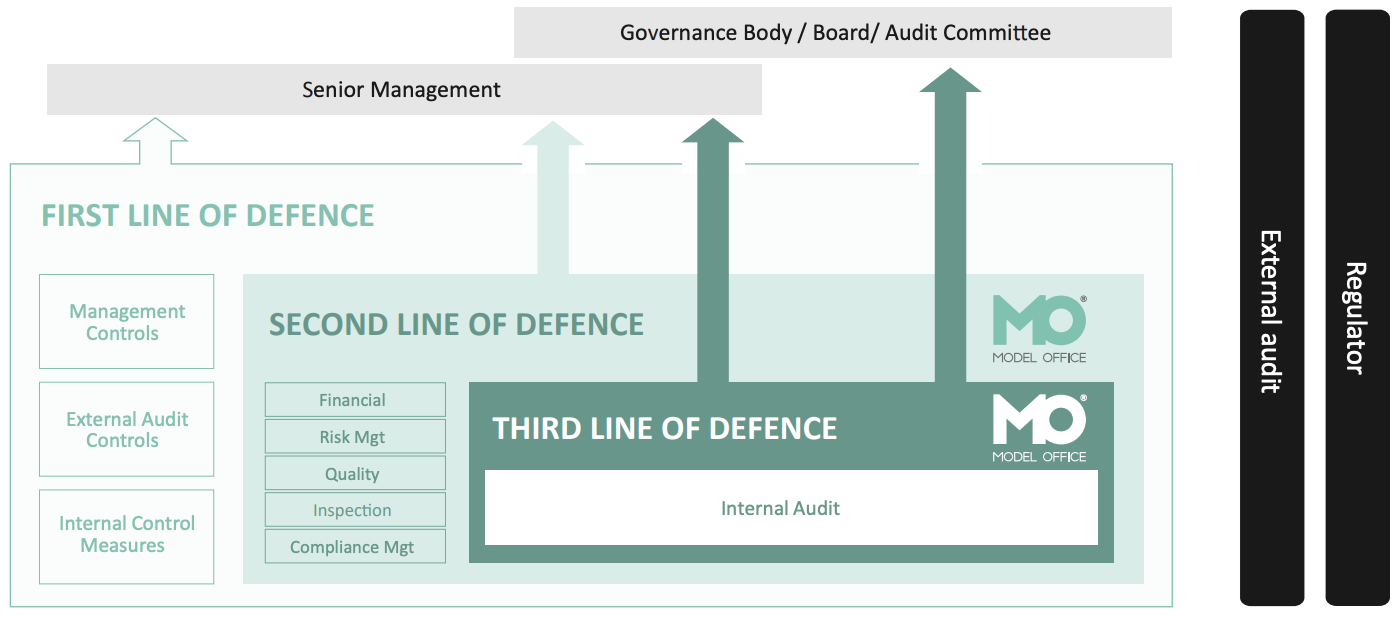

Governance, Risk and Compliance (GRC) and Technology’s Role in the ‘Three Lines of Defence’

[fa icon="calendar'] Aug 12, 2021 9:30:40 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, MiFIDII, Data, GDPR, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice, AI, GRC, governance, compliance

Let’s start with the top three challenges firm’s face when it comes to GRC management.

Why RegTech data matters

[fa icon="calendar'] Jun 25, 2021 10:45:02 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, resilience, cyberrisk

We currently have a festival of football with the UEFA European Championship, and you can be assured that each national team coach will be using data analytics to assess their own and opposition teams and players strengths, weaknesses and winning formations.

The FCA RegData and Digital Regulatory Reporting

[fa icon="calendar'] Jun 11, 2021 10:59:11 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, resilience, cyberrisk

As of May 2021, RegData completely replaced Gabriel as the FCA’s platform for data collection after a lengthy roll-out to 52,000 firms and 120,000 users. Firms and their users were moved to RegData in groups, based on their reporting requirements.

The FCA Consumer Duty

[fa icon="calendar'] May 27, 2021 4:37:12 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, resilience, cyberrisk

The FCA first published their duty of care paper in July 2018. Two years on it is now consulting on introducing a new consumer duty. This consultation ties in with the new FCA ‘outcomes’ focused principles based framework and is open until 31st July 2021 and following section 29 of the financial service act 2021, should be introduced by 1st August 2022.

Fish cannot see water

[fa icon="calendar'] May 21, 2021 9:42:19 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, resilience, cyberrisk

With Daniel Kahneman’s co-authored latest book, ‘Noise’, we have another instalment for the case of behavioural science in decision making.

Remote working and the compliance challenge

[fa icon="calendar'] Apr 23, 2021 10:16:12 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, resilience, cyberrisk, levies

Enforcing regulatory compliance can be enough of a challenge when your workforce is in the office. When they are dispersed, how can you be sure that your marketing and communications collateral adheres to FCA rules?