With the latest FCA consultation paper for improving regulatory oversight of the Appointed Representative Regime, without a cohesive, coordinated approach, Principle firms governance, risk and compliance (GRC) systems and control audit resources may not be deployed effectively and significant risks maybe missed. This can lead to mis communications and dysfunctions within the Principal firm internal GRC practice, poor reporting, market risk and poor consumer outcomes across AR activities. With the FCA’s new proposals, based on a background of poor consumer outcomes at the hands of ARs, Principals and their ARs now need to employ RegTech to gain clear and accurate data analytics across all activities to ensure they comply in order they can continue to compete. This blog looks at the key themes and how RegTech can support Principal firms and their ARs.

Notification and reporting

We detail in the below table the key issues the FCA are focused on and how Model Office’s RegTech and streamlined audit capabilities can ensure Principals and their ARs can meet the new proposed stringent regulations.

|

|

AR |

IAR |

|

Reason for the AR appointment |

Yes |

No |

|

Regulated activity to be used |

Yes |

Yes |

|

Description of AR’s non-regulated activities |

Yes |

No |

|

Provision of services to retail clients |

Yes |

No |

|

If the AR was an AR of another principal previously and why the new arrangement |

Yes |

No |

|

Whether the AR is part of a group |

Yes |

No |

|

Secondment from the AR to the Principal |

Yes |

No |

|

Estimated revenue |

Regulated and non-regulated |

Regulated only |

|

Nature of financial arrangements |

Yes |

Yes |

The timeframes are new for most sectors and gathering information for existing AR might be a challenge even if they have the information

|

Notification |

Timeframe |

AR |

IAR |

|

Existing ARs – provide the new data |

Within 60 days of the rule coning into force |

Yes |

No |

|

New AR |

At least 60 days before new appointment |

Yes |

Yes |

|

Ad-hoc notification; change of AR’s name and/or regulatory activity |

At least 10 days before changes takes effect |

Yes |

Yes |

|

Regulatory hosting |

At least 60 days before offering regulatory hosting |

Yes |

Yes |

Regulatory notification challenges and Model Office RegTech

There are several challenges that arise from the above notification and reporting requirements. It is now imperative that Principles and their ARs adopt RegTech and digital audit capabilities to ensure:

- AR frameworks and appetite are sufficiently robust to support these new notification and reporting requirements

- Principles can gather the required information and ensure its accuracy

- Principles can keep up to date with AR business changes to appropriately

RegTech will also ensure Principals can gather evidence and information in a timely and accurate manner and data is complete and appropriately allocated to ARs across;

- Verification of AR details on the FR register and attest as part of the FS register annual attestation that AR information is correct which aligns with the FCA ‘use it or lose it’ permission approach

- Providing complaints data for each AR on an annual basis – 30 business days of the end of the relevant reporting period

- Providing revenue information within 30 business days of firm’s accounting reference date, for each AR/IAR with IAR limitations for regulated revenue and non-regulated revenue also required for ARs. This could include individual adviser personal finances

- Complying with Principle 11 disclosures

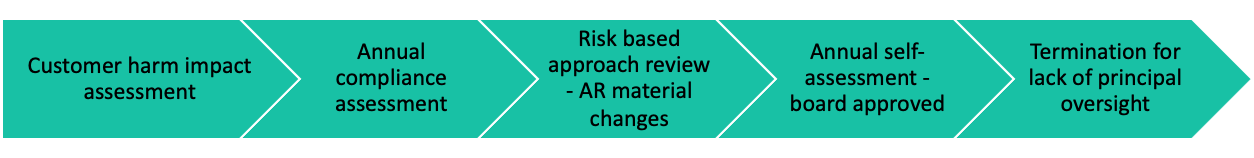

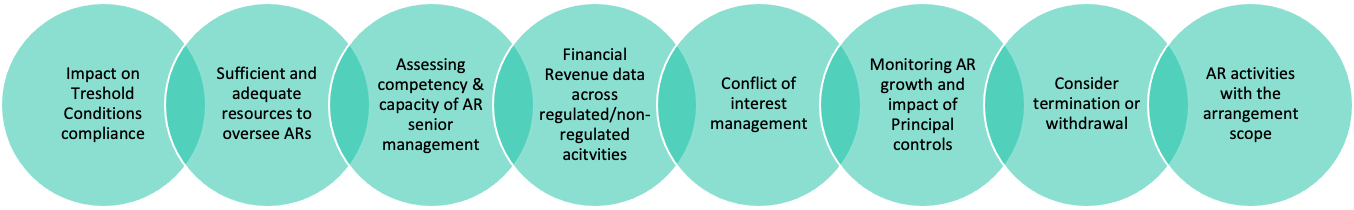

Due diligence and oversight

Principals are already subject to requirements to undertake due diligence prior to appointing an AR and to oversee them on a on-going basis. However, repeat weaknesses have been identified I this area. To remediate, the FCA is proposing to include additional requirements and develop further its handbook guidance to clarify their expectations.

New Due diligence and oversight requirements

The FCA is enhancing several of its existing guidance under SUP 12 to provide further clarity on their expectations:

RegTech will enable principals and their ARs meet such supervisory requirements with data analytics providing themes and trends across AR behaviours and activities.

Regulatory hosting

The FCA are proposing a firm;

- That offers or provides a service by which unauthorised persons (whether or not closely linked) may become ARs of the firm

- That markets of offers the above service to unauthorised persons as an alternative to applying for authorisation

- That provides the above service for remuneration with a view to profit and;

- To which either the below applies;

- The firm does not carry on any regulated activities in a principal capacity, or

- The regulated activities carried on by one or more AR of the firm are not connected to any regulated activity undertaken in a principal capacity

When it comes to regulatory hosting the FCA are looking at:

- Prohibiting regulatory hosting

- Reducing AR regulated activity

- Limiting the size of ARs

- Developing additional specific rules for regulatory hosting

- Limiting the number of ARs a principal can have

- Relying on the current proposal amendments

- Approving larger ARs and Regulatory Hosting

Summary

With a principles and outcomes focused regulatory framework, it is not uncommon to find diverse audit, risk management, inspector and control specialist teams, strategy and methods employed to manage GRC challenges. One problem this promotes is ‘swivel chair’ compliance where professionals use disparate resources to manage their GRC risks. Where Principles and their ARs are concerned, Principal compliance teams need to be aligned in their approach and gain accurate management information (MI) to know their AR firms are behaving correctly.

Please click the below icon link to the 'Lite' (free) platform and learn more about MO today..