So, the final rules are here and not much has really changed other than the implementation period has been extended slight for live business to July 31st, 2023, and closed book business has until 31st July 2024. Plus (wait for it) firms need to be up and running on their implementation by October ’22! Although any extension is welcome, it’s not long enough in my opinion given the ramifications this all-encompassing regulatory directive brings. Think Operational Resilience which has an implementation and transitional period totalling four years!

In their Policy Statement PS22/9, The FCA painstakingly go into great detail on what their consumer duty actually means when applied to firms’ daily practices. This is actually helpful and provides a framework that firms can work with to assess their products and services, client engagement strategies and make the relevant changes to ensure they stand the best possible chance of complying come this time next year. I say the best possible chance, because there are so many variables and interactions with existing rules that need to be taken into account.

What is good is yet again the FCA have issued a separate policy guidance with good outcome examples, in particular culture and governance is given prominence with the FCA outlaying key questions firms should be asking themselves over the next year. In essence, firms now need to become research houses to assess their client engagement and associated culture, something Model Office heat mapped dashboard do in benchmarking firms against regulations. Indeed MO is now locked and loaded for the consumer duty, so all firms using our RegTech will gain all the information they require and build an audit trail evidencing their implementation and compliance.

The FCA make pains to emphasise the importance of the cross-cutting rules and how certain tests can help firms bring objectivity to reasonableness, god faith and foreseeable harm such as;

- Assessing the nature of product or service offered

- Knowing characteristics of retail customers (vulnerable/financial capability)

- Knowing firms’ role(s) in products/services including their distribution chain

- Applying the same standards and capabilities to delivering good customer outcomes as they are to generating sales and revenue

Given the far-reaching effects of this new Duty, the FCA make it very clear it is now a firm’s board duty to oversee and implement the regulations correctly. Thus firms should understand the changes to (Duty of Responsibility, board consumer duty champion (ideally a NED and consumer duty 'culture carrier') individual conduct rule 6 scope of job duties) and revisit the conduct rules under the Senior Managers and Certification Regime (SM&CR).

To understand what action you may want to take over the next twelve months it is worth focusing on the Consumer Duty four outcomes:

1. Product and services outcome: Knowing your services and products and how they relate in the distribution chain is essential. This means assessing any ancillary activities including unregulated activities necessary to the completion of regulated activities for example product design and your services strategy. It is worth noting unregulated firms are bound by the general consumer law including consumer protection from unfair trading regulation 2008.Outsourcing is key here as most firms use this strategy but only applies if there is a material influence on consumer outcomes for instance SYSC 8 outsourced firm requirements meet relevant aspects of duty

A benchmark firms should use is to consider conditions that applied when products were sold, and assess expected costs over the lifetime of the product this means assessing for ensuring fair value at all times, so firms will need to devise tests to do this. I personally cannot see any other way than client surveys and focus groups being used to identify potential detriment then avoid causing foreseeable harm and provide ongoing fair value for example by changing a charging structure, or updating service features and benefits.

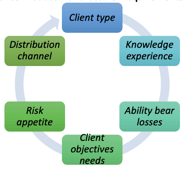

Figure 1. PROD strategy

The key to this outcome is the Product and Governance rules (PROD) and as the FCA put it so succinctly; failing to comply with PROD 3 means failure to meet products and services outcome! Figure 1 showcases what steps firms need to do and evidence they are doing with their clients across all segmentation and engagement.

The key to this outcome is the Product and Governance rules (PROD) and as the FCA put it so succinctly; failing to comply with PROD 3 means failure to meet products and services outcome! Figure 1 showcases what steps firms need to do and evidence they are doing with their clients across all segmentation and engagement.

2. Price and value outcome: The final rules make it clear firms need to conduct continuous value assessments across what do clients gain, value most from product and services. There are challenges here such as;

-

- intricate interrelationship with existing regs such as PROD 3 & 4, collective investment schemes sourcebook (COLL) so COBS 19 Independent Governance Committees (IGCs) and Governance Advisory Arrangements (GAAs) assessments can provide product fair value strategy

- Control or lack off within distribution chain

- Duplication of assessments lead to inefficiencies

Whilst the FCA have made it clear that sensitive information need not be shared, it is clear that they demand firms challenge themselves and their clients in assessing the value of their services and products services and products. It is worth revisiting a number for previous regulatory papers here as the below table shows which provide good outcome examples on different aspects of products and services suitability in meeting client’s ongoing needs.

Table 1: Regulatory adviser charging strategy resources

|

FG12/16: Assessing suitability: replacement business and centralised investment propositions |

· Firms should ensure robust systems and controls when the recommending replacement of an existing investment, assessing that the costs are in the client’s best interests · A segmented client bank may result in different charging structures, service levels and benefits and clients should be informed in a way that is clear, fair, and not misleading |

|

|

TR14/21: Retail Investment advice: Adviser charging and services |

· Firms need to ensure they disclose charges in cash terms · Hourly rates should provide approximate timescales · Avoid using wide ranges in generic disclosure of costs and charges · Consumer research evidenced costs should be disclosed in readable font size, services and costs displayed together, use bullets, diagrams, bold text and smaller documents |

|

|

Supervision review report:Acquiring clients from other firms |

· Client’s suitability needs should be adequately and consistently evidenced · Impact on commercial benefits on clients should be factored in · Consistent approach is needed when considering and mitigating potential disadvantages |

3. Consumer understanding outcome: If you remember the FCA launching in 2013, it was all about Behavioural Economics and a big part of this was how to ensure client understanding for services and products. Bulleted and layered communication approaches with signposted information works well and should be considered particularly with client agreement, suitability reports and cost disclosure. Data protection laws such as the UK General Data Protection Regulation (GDPR) and PECR need to be applied at all times.

In line with gaining client views through surveys firms will now have to consider applying testing: strategies that go further than Principle 7 clear, fair and not misleading and test what works in practice. Firms need to gain assurance and evidence that consumers can identify and understand the information needed to make effective decisions. Key points to consider here are;

- The actions required by customers and consequences of inaction

- Key benefits, costs and risks of product or service customers need to evaluate or make a choice about the product or service

- Customer access to additional information or support

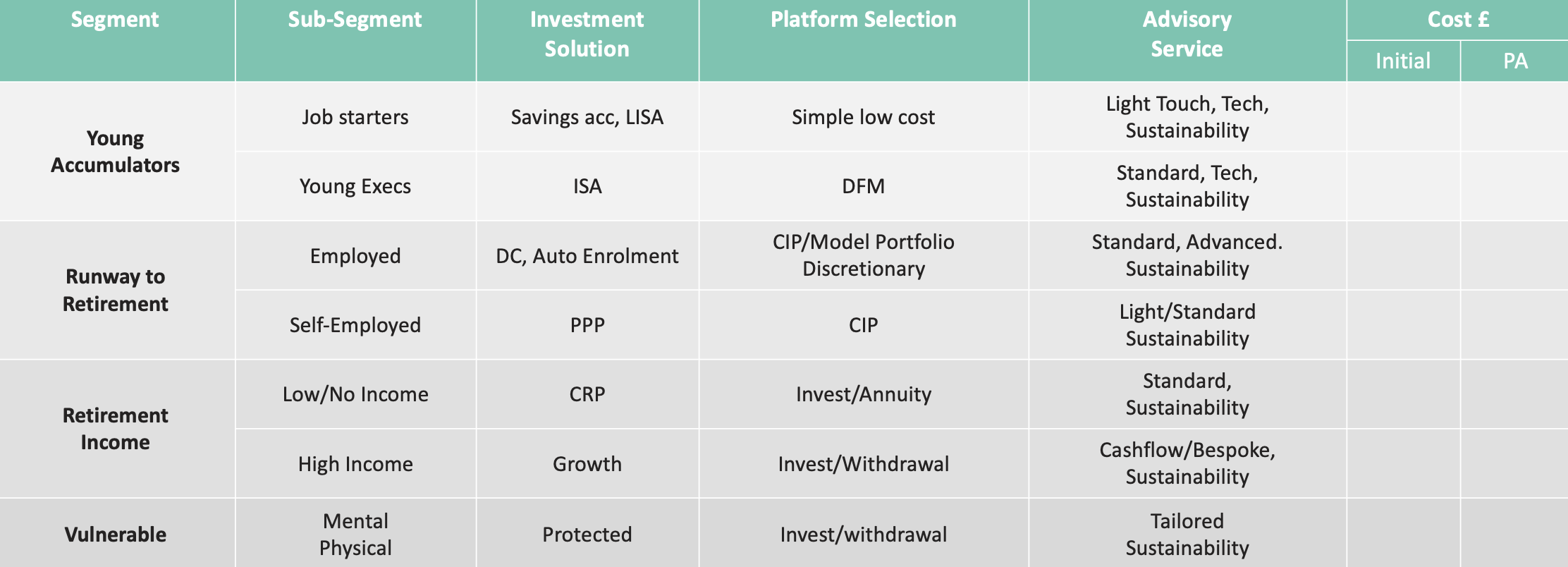

4.Consumer support outcome: Firms need to continually monitor and support customers to ensure the service and product supports are adequate to meet ongoing needs, as our below table illustrates, the firm’s client segmentation strategy is crucial in ensuring each client segment has right product and services to meet their on-going needs and requirements, including vulnerable clients. This means firms should;- Monitor the support provided and gain feedback and gain management information that a distribution channel is working or not

- Be flexible with customers’ needs particularly vulnerable, protected customers (equality act 2010) and client changing needs

- Communicate support available clearly at all times

- Ensure any support is effective

- Operational Resilience is in place and tested in case any support services or products are compromised

Table 2. Consumer Duty client segmentation strategy

There is plenty more to go at, but the final rules cement CP21/36 and ensure firms now know the extent of the challenge ahead over the next twelve months. Advice firms now need to take full ownership of their client relationships across the distribution chain, ensure all contracts are aligned with the new Duty, have a very good idea on ‘who owns the client relationship’ and ensure cross cutting rule tests, PROD, segmentation and client engagement and assessment strategies are in place sooner rather than later to gain the best possible chance of a constructive client-centric culture and their staff have the right skills and behaviours when it comes to complying with the Consumer Duty.

As the FCA has now become a data led regulator, It is clear advice firms now need to ensure that their data it up to scratch and incorporates the four outcomes’ requirements this consumer duty demands.

For more on the Consumer Duty and how Model Office RegTech can help, download our guide here.

Please click the below icon link to the 'Lite' (free) platform and learn more about MO today..