With the retail investment adviser (RIA) market now under severe scrutiny via the FCA’s accountability regime, their latest Data Bulletin focused on 2018 RMAR driven data analysis across revenues, profitability, number of firms, capital resource, Professional Indemnity Insurance (PII) premiums and advice type and revenue from adviser charges.

What were the Key Findings?

- RIA numbers are up by 5% since 2016 with 26,677 advisers in the UK

- Retail investment revenues increased from £3.95BN to £4.42BN (12%) Mortgages £1.18BN an increase of 16% and Non-investment business £18.2BN an increase of 8%.

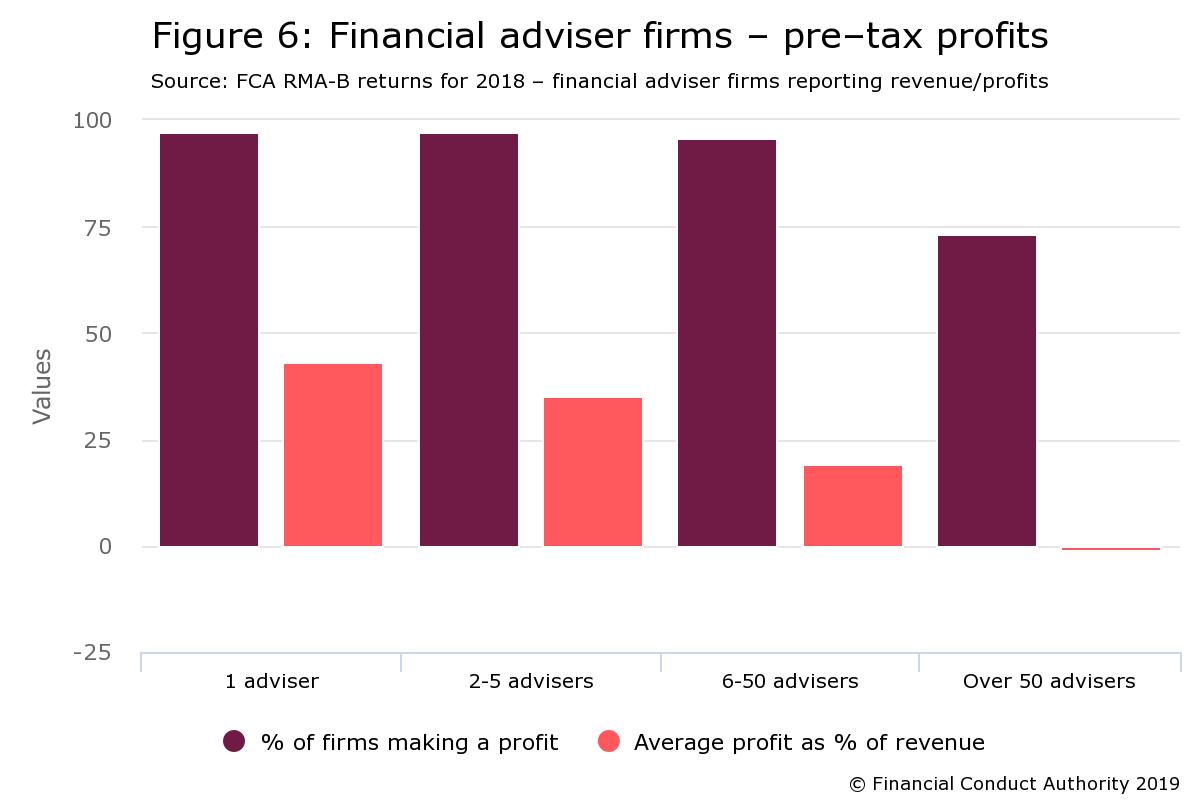

- Pre-tax profits are on the up with 96% of RIAs making a profit with total pre-tax profits up to £872M from £698M

- Commission is the dominant revenue source for the Mortgage and Insurance sectors, yet amongst RIA’s this accounted for 17% only with fees and charges accounted for 80%

- RIAs with between 5-50 advisers continue to make more money per adviser than either smaller or larger firms, yet small firms remain a significant portion of this sector with nearly 9 in 10 financial adviser/Mortgage brokers have 5 or fewer staff

- PII premiums relate to approximately 2.5% of revenues and revenue for restricted advice firms are on the up relative to independent advice

What does this mean for the sector?

Well as we know at Model Office, data can be deceptive and you need a critical eye and look at the underlying trends and sources to ensure a robust and holistic picture is gained.

- Firstly there is a lot of debate on the quality of data on RMAR and if this is truly reflective of all costs associated with running a business in this sector

- Next the revenues need to factor in how income is taken; does the firm take a salary or a mix of salary and dividends?

- Also are indirect costs being factored in particularly around compliance and outsourcing? For example the FCA Financial Advice Market Review 2017 found small to mid-size firms are paying 11% of their income on regulatory costs! This includes direct (fees/levies) at 3% and indirect (staff/outsourced support) at 8%.

If we factor the above 3 points in then the below table can be challenged in particular around the percentage of profit/revenue particularly as these firms margins a slim in this hard PII market we now find ourselves.

Also those larger firms with over 50 advisers are loss making and those who have 5-50 make the highest average profits. We have to take into account the fact that with the new FOS compensation limit (£150-£350K) PII rates have reported to have quadrupled in some cases! The knock on effect on smaller firms in particular is huge and thus these reported figures should be viewed with this in mind.

Also those larger firms with over 50 advisers are loss making and those who have 5-50 make the highest average profits. We have to take into account the fact that with the new FOS compensation limit (£150-£350K) PII rates have reported to have quadrupled in some cases! The knock on effect on smaller firms in particular is huge and thus these reported figures should be viewed with this in mind.

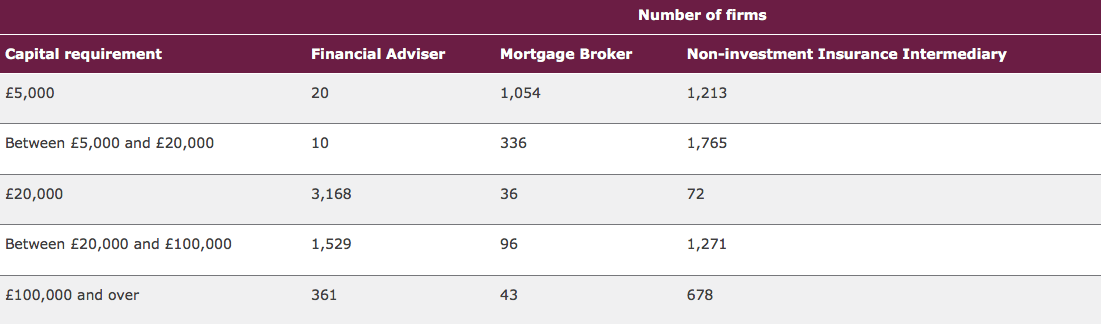

On a positive note though revenues are on the up as are adviser numbers and the vast majority of firms are showcasing a professional approach to running their businesses and reflected in more firms holding capital required of £20,000 or more.

If we take into account the FCA FAMR benchmark work in relation to compliance costs, this then equated to 11% of total industry revenues, some £550M, this with an increase in consolidation maybe reflected in a higher number of restricted firms against independent means this sector remains buoyant but challenged.

What can firms do to remain profitable?

It is important for RIAs to have a firm handle on both regulatory and financial risks. The best way to do so is to employ diagnostic technology and ensure they gain accurate and meaningful Management Information (MI) on their KPIs.

At Model Office we ensure firms can benchmark all relevant rules and regulations across the business with its algorithm providing real time and tailored scores, tasks, resources and templates for firms to assess and continuously improve.

The system has also just launched at Intelliflo’s London 2019 Change The Game Conference a free financial stress test diagnostic that allows firms to assess their on-going profitability across key metrics such as Adviser and Para-planner productivity, assets under management, income streams and gross-net profitability.

So with the FCA’s accountability regime in mind, firms now need to constantly prove they have the finger on the business health pulse across competence, conduct and profitability. After all clients will trust a firm who knows its strengths and builds strategy around its weaknesses.

Please click the below icon link to MO®'s #RegTech platform and learn more about MO® today..