Twitter has been very active with the latest FCA call for input: Consumer Investments and the issues surrounding ensuring fair levies and identifying rogue firms who should bear the brunt of these costs.

Indeed the Model Office team have replied to Question 29 of this paper What more can we do to ensure that compensation paid for fairly by those that cause the loss? which you can read below 👇🏽It showcases how RegTech can ensure that FCA, FSCS and FOS plus PII underwriters can better assess individual firm risk rather than benchmarking the industry based on hard market risks.

Q29: What more can we do to ensure that compensation paid for fairly by those that cause the loss?

The issue the industry faces with climbing regulatory levies is unsustainable with retail investment advice firms (RIAs) expected to shoulder increasing compensation levies against their turnover and squeezing margins thus placing pressure on ability to grow business services to meet client needs and passing on levy costs to their clients.

Also, the fact that the Financial Services Compensation Scheme (FSCS), Financial Ombudsman (FOS) and Professional Indemnity Insurers (PII) all tend to assess market risk rather than individual firm risk is a problem.

In many ways (in our opinion) the FCA are tackling the answer to this question from the wrong starting point. Rather than focus on attempting to identify those rogue firms that are consistently causing consumer detriment through misselling and unsuitable advice. There is a case for adopting Regulation Technology (RegTech) tools that can help identify those firms that are consistently meeting advice suitability regulations and running their businesses in a highly compliant fashion.

RegTech has been on the rise for the last few years and has developed to meet market participants needs for identifying, managing and monitoring regulatory governance, risk and compliance (GRC). As can be seen from the below RegTech Associates regulatory change market map, there are many solutions now available for firms to engage with dependent on their business model, compliance and customer needs.

Image 1 RegTech Associates compliance management market map

What is very apparent from our work in the RegTech sector is that technology can provide evidence based practice to identifying good and bad GRC practice and ensure firms evidence they are ‘walking their talk’ on regulatory GRC competence and conduct requirements.

RegTech that monitors a firms GRC can then provide hard evidence that a firm is meeting all relevant regulatory requirements at business operations, systems and controls and people management level. This can in turn, provide valuable data to PII underwriters across their risk evaluation metrics that a firm risk (rather than a market risk) is the main factor for assessing the premium levels and any necessary premium risk loading.

The FSCS can also use such RegTech data to better assess the soft and hard facts across business behaviours in the market and come to an informed (evidence based) judgement on firm levies. Such GRC conduct and competence evidence based data should allow the FSCS to class firms more realistically and thus segment the market fairly into those firms performing well, those who need more support and the rogue firms causing the most damage.

The current ‘homogenous’ approach taken tends to place all firms within the same class and thus we have the issue where compensation is paid by all, not just those that cause the loss (if they are still active and have not attempted ‘pheonixing’).

By using RegTech GRC data, regulatory stakeholders will be able to better segment the market and thus then identify those firms causing detriment who should pay and if found insolvent then any wind up should include terms for payment of a levy from available assets.

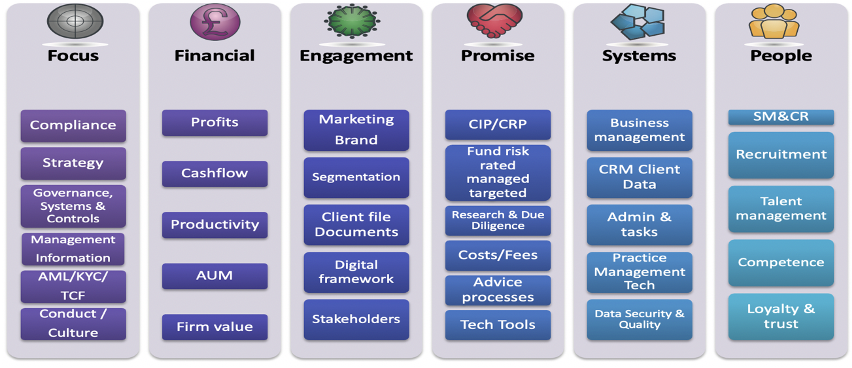

For example Model Office-MO® is able to segment GRC activities broadly into 6 keys areas: Focus (all key compliance directives include suitability) Engagement (Client and Stakeholders) Promise (Service proposition, product research and due diligence (incorporating PII risk assessment) advice strategies, tools and technology) Systems (Practice Management operations, systems and controls plus data security and management) People (Human Resource Development, Competence and Conduct) Financial Resilience (Cashflow) The system will then offer a more granular approach across these areas where firms will audit and gain risk based scores across business functions in each key. This offers a risk based approach and ‘hard and soft’ data on the GRC performance on an on-going basis.

Image 2 Model Office 6 regulatory keys

This can then produce a holistic view on a firm’s GRC strategies and gain an appropriate risk based market segmented framework and facilitate a levy directly correlated to the evident firm risk.

We note a risk based approach was investigated by the FCA in CP 18/11 and we would encourage the regulator to adopt RegTech as an enabler to identifying good and bad risk management practice in firms conduct, competence and culture, acting as a benchmark to identify and segment firms by the very nature of the risk they present.

The fact that The FCA Financial Advice Market Review baseline report estimated that a firms direct and indirect compliance costs are (on average) 11% of turnover means there is a real risk that those businesses who are performing well and represent a good risk are suffering and their margins are being severely squeezed, so it is imperative that the regulator walks its talk on RegTech and applies such to ensure firm risk (not market risk) is identified and scrutinised to ensure a fair application of levies and those rogue firms are identified quickly and dealt with appropriately.

If you're interested in finding out more you can book a demo of our software please click below to see MO® in action.

Please click the below icon link to MO®'s #RegTech platform and learn more about MO® today..