When they are not on strike, the FCA are producing promising work. Their new business plan and focus on metrics and outcomes is a case in point. This business plan takes a new form in that it is hosted digitally on a webpage which provides hyperlinks to other relevant resources such as their three-year strategy and excellent Regulatory Initiatives Grid.

Gone are specific sector plans which could make it harder for firms to identify what is relevant to them, but what is good is the new outcomes focused strategy incorporates the previous business plan’s seven strategic transformation themes and adds thirteen outcomes strategies which firms can benchmark their journey to ensure they are on track.

What is clear is the City watchdog are walking their talk when it comes to applying digital and data analytics to their regulatory activities, tools and interventions and strategy. So it follows that firms now need to apply RegTech to their governance, risk and compliance practices, plus, given the FCA focus on synthetic data, the industry needs to start offering anonymised data lakes for RegTech platforms to deliver true streamlined regulatory reporting, quality management information, saving firms time and cost.

With the FCA clearly moving towards a data led regulator via applying outcomes and metrics with cloud and potentially Artificial intelligence (AI) to identify firm risks, the old compliance mantra, ‘If it is not written down, it did not happen’ is dead. It is now; ‘If you have not got the data, it did not happen’.

The business plan thematic approach

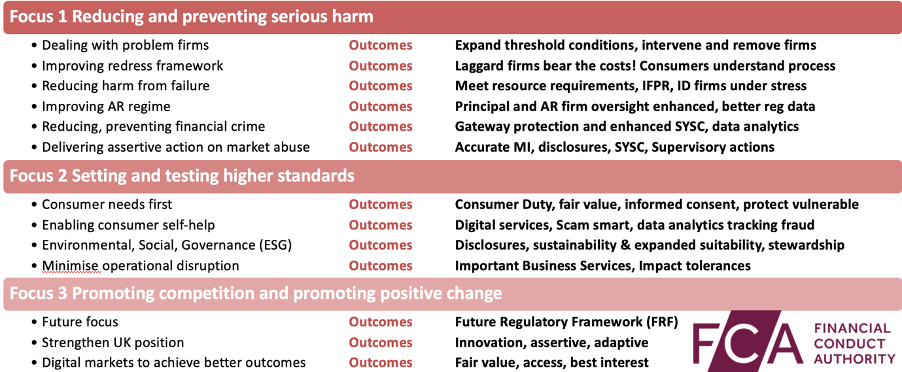

Many of the themes the business plan covers have already been introduced and it is focused on three areas as can be seen below:

Figure 1. FCA Business plan 3 areas of focus and desired outcomes

Source Model Office

When it comes to cross-market priorities the three areas for focus provide the FCA with an assertive and adaptive approach:

Focus 1: Reducing and preventing serious harm

- Automate the Threshold Condition breaches identification process

- Revise and increase appointed representative and their principal firm supervision

- Complete the ‘Cancellation of Firm Authorisation Project’ i.e. speeding up removing authorisation

Focus 2: Setting and testing higher standards

- Finalise the all-new Consumer Duty rules

- Target high risk investments financial promotions and crypto-assets

- Expand advice suitability to incorporate ESG sustainability and ESG product disclosure

- Enforce the new Operational Resilience rules via the FCA Technology, Resilience and Cyber Department

- Focus on critical third parties via a discussion paper and new rules

Focus 3: Promoting competition and positive change

- Work with HM treasury and Future Regulatory Framework

- Work with the government on digital markets, incorporating the FCA Digital Regulatory Reporting initiative.

- Incorporating consumer digital journey’s to nudge customers to act in their own best interests.

- Focus on AI in financial services

How can firms comply?

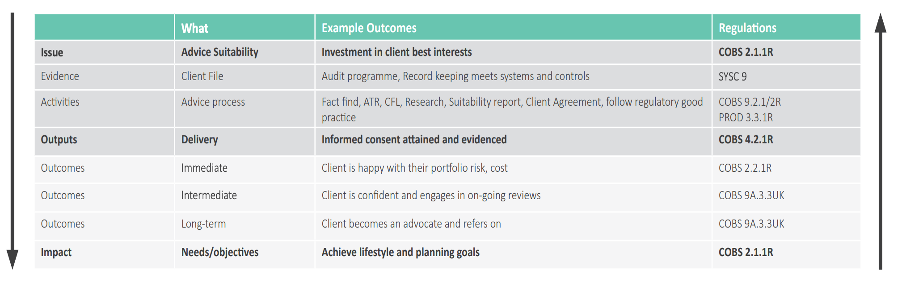

Starting with the end in mind is the best way firms can approach the new FCA outcomes focused regulatory framework. This means tracking the actual outcomes clients are experiencing then applying the regulations as a test to see if services and products comply. If data analytics are used, then firms will then gain the evidence required to ensure their services and products are meeting the regulations. At Model Office we have built our RegTech diagnostics around a ‘logic model’ this will ensure firms have all the data and evidence that they are complying or what they need to do to comply if not.

Figure 2. Advice suitability outcomes focused logic model example

Source Model Office

Source Model Office

You can read more on logic models and outcomes focused regulations in our latest review paper here.

What does all this mean?

With a focus on measuring outcomes via metrics, this provides a more flexible approach for firms to work through the outcomes their services and products are providing their clients rather than start with the regulations themselves. This means an innovative approach is encouraged allowing firms to tweak or build new services to meet on-going client needs.

This will require firms to adopt RegTech, technology that provides benchmarked and heat mapped dashboards, regulatory alerts and data analytics across their performance against key regulatory risks such as; AML, KYC, SYSC, Financial, Cyber, Operational Resilience, SM&CR, Training and Competence, PROD, IFPR and much more..

The good news is investment in such technology can streamline internal and external audits, act as a third line for defence and reduce compliance costs and time. All while ensuring forms obtain the data and evidence they comply and can continue to compete.

Please click the below icon link to the 'Lite' (free) platform and learn more about MO today..