The Good King FCA last looked out

Good King Conduct Christmas Carol

[fa icon="calendar'] Dec 21, 2018 9:43:44 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, Modeldrivenmachineexecutablerporting, digital,, Regulatory, Reporting, BREXIT

BREXIT Fray Bentos and Ice Cream Vans

[fa icon="calendar'] Nov 30, 2018 12:15:59 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, Modeldrivenmachineexecutablerporting, digital,, Regulatory, Reporting, BREXIT

Like you, I get most of my Brexit updates from the @Coldwar_Steve twitter account. Based on this, Boris Johnson is currently panic buying Fray Bentos tins from a reconditioned ice cream van.

Are you BREXIT ready?

[fa icon="calendar'] Oct 26, 2018 11:33:20 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, Modeldrivenmachineexecutablerporting, digital,, Regulatory, Reporting, BREXIT

The UK’s exit from the EU will doubtless create challenges for Business owners, Client Relationship owners and Compliance Officers. They all need to understand any changes in order not to fall foul of the regulations after March 2019. The FCA have published two consultation papers, setting out its proposed approach on the UK’s exit from the EU in the event of a ‘hard’ Brexit.

Really want to move your back office technology?

[fa icon="calendar'] Oct 8, 2018 2:22:03 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, Modeldrivenmachineexecutablerporting, digital,, Regulatory, Reporting, IDD, backoffice

Open-heart surgery is something one would want to avoid where our own health is concerned. Yet in businesses we seem to be witnessing such when it comes to established firms moving their businesses between technology providers.

Are you IDD ready?

[fa icon="calendar'] Sep 28, 2018 12:34:20 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, Modeldrivenmachineexecutablerporting, digital,, Regulatory, Reporting, IDD

The Insurance Distribution Directive (IDD)concerns the distribution of insurance-based investment products (IBIPs). It also covers firms that assist in the administration and performance of an insurance contract post-sale. It aims to create a level playing field for all those involved in the sale of insurance products.

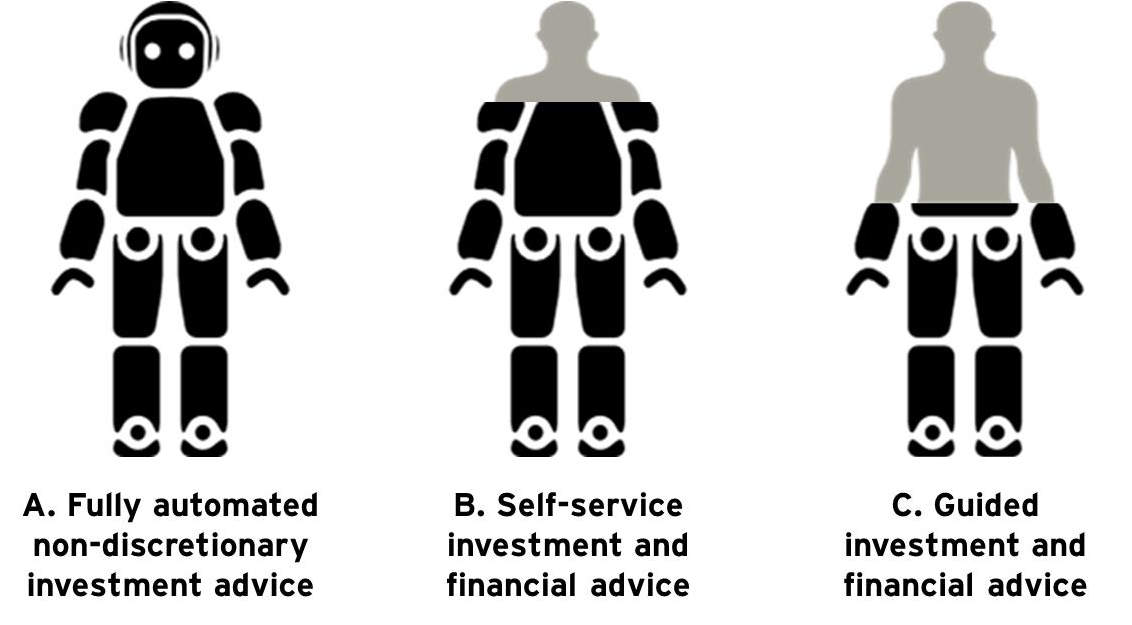

Are the Suitability rules Suitable for the Robo's?

[fa icon="calendar'] Sep 14, 2018 10:46:51 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, Modeldrivenmachineexecutablerporting, digital,, Regulatory, Reporting

With The FCA revisiting the implementation of MiFIDII and with the next Suitability review, and SM&CR also on their way, we are now seeing far more focus on disclosure, transparency, accountability and roles and responsibilities.

What is #RegTech and how can it help your firm?

[fa icon="calendar'] Sep 7, 2018 12:36:39 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, Modeldrivenmachineexecutablerporting, digital,, Regulatory, Reporting

The term 'RegTech' was coined in 2015 by the Financial Conduct Authority, which described it as “a sub-set of FinTech that focuses on technologies that may facilitate the delivery of regulatory requirements more efficiently and effectively than existing capabilities".

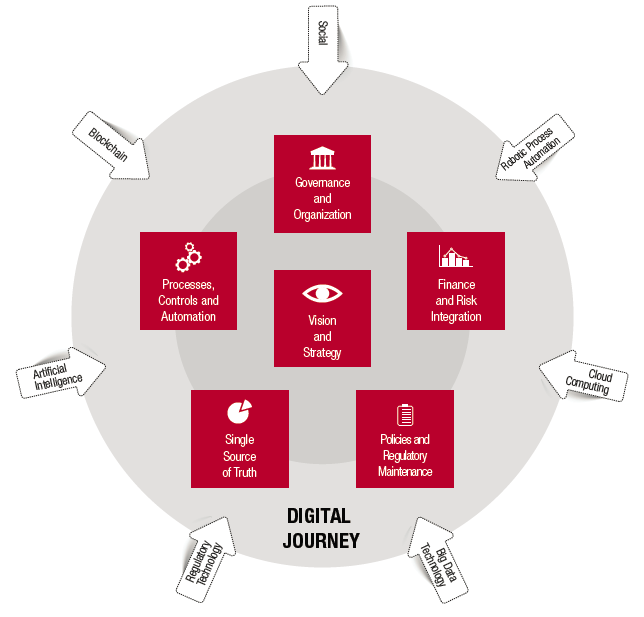

Streamlining your regulatory reporting with #RegTech

[fa icon="calendar'] Aug 31, 2018 3:22:49 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, Modeldrivenmachineexecutablerporting, digital,, Regulatory, Reporting

What if the regulatory handbook was machine-readable and your firm could assess select rules, apply to the business’s data, tasks and actions and interpret this and report back to the regulator at a click of button?

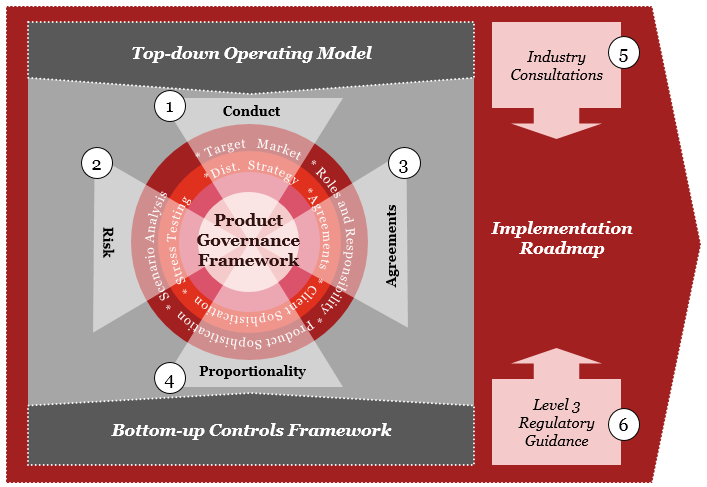

Why PRODing your clients is a good thing

[fa icon="calendar'] Aug 24, 2018 10:17:08 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance

The missing link between advice suitability and appropriateness of product in meeting client needs was delivered for retail investment advice firms with the introduction of Product Governance and distribution rules i.e. PROD 3.3 in particular.

Marrying Business and Compliance Risks

[fa icon="calendar'] Aug 17, 2018 1:30:30 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms

One of the biggest risks we see Retail Intermediary Advisers (RIAs) make is confusing compliance and business risk. For example, recommending a product that is deemed suitable to meet current client needs doesn’t make it a good risk when viewed from a business legacy viewpoint i.e. client circumstances change, their perceptions change thus their trust and informed consent is at risk if they are not serviced correctly and thus lost trust and complaints become a business risk via fines and damaged reputation or worse.