Terminology is everything we hear, as the financial services industry seems to enjoy loading up on acronyms and jargon for simple processes. Just think of AER, CREST, Dematerialisation, Dirty price, FRNS, HICP – I could go on, so since the RDR (another one) we have been called to the transparency table. So where pricing and charges are concerned, for example, we have a need for clear and unambiguous charging delivered in simple terms.

Chris Davies

Recent Posts

The FCA's new era of accountability and 5 conduct risk questions

[fa icon="calendar'] Jul 3, 2018 5:58:15 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability

The Luddite fallacy and the rise of Artificial Intelligence in Retail Financial Services

[fa icon="calendar'] Jun 15, 2018 2:19:44 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice, AI, Luddite

‘The luddites destroy the robots’ may make an attention grabbing headline, yet with all the hype around job losses caused by machine learning and Artificial Intelligence (AI) we need to gain some perspective on where we’re at and where we’re heading.

Unconscious bias and suitability conundrum

[fa icon="calendar'] Jun 1, 2018 9:47:02 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice

When Starbucks closes 8000 stores across the USA, you know there’s a problem. It was reported that due to staff’s unconscious racial bias two men were asked to leave and then arrested for ‘loitering’ in a Starbucks café when all they wanted was to buy a cup.

The FCA Streamlined Slap for Robo's

[fa icon="calendar'] May 23, 2018 10:23:55 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice

During our tour of the UK last year promoting our RegTech platform Model Office, we made it clear that those firms employing the poorly named Robo-Advice solutions really needed to employ research and due diligence on the technology before employing it within their business proposition.

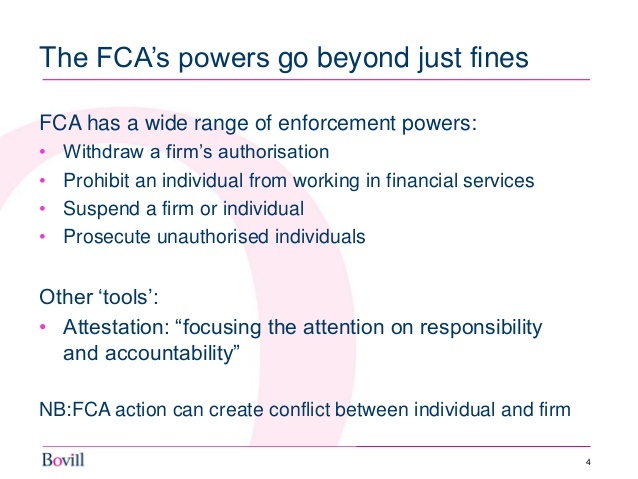

Accountability, Fines or Prison: Your Choice

[fa icon="calendar'] May 11, 2018 3:16:53 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct

‘We strongly encourage firms and senior management to continue to focus on their conduct and culture and to ensure that good practice becomes embedded throughout their firm' The FCA 5 Conduct Questions April 2018.

The FCA Complaints data, TCF and #RegTech

[fa icon="calendar'] May 2, 2018 1:43:30 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit

The FCA complaints data can read like the opening credits of a disaster movie: LIBOR rate rigging, Long term Care, Payment Protection Insurance miss-selling, product and fund churning, (are you already switching off yet), this results in an industry tarred with a brush that has seemingly painted graffiti all over the Treating Customer Fairly (TCF) principles.

What's New with MO® Compliance Chat?

[fa icon="calendar'] Apr 18, 2018 8:07:23 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, FCAbusinessplan, audit

MO® represents an industry first in many ways. Not only is MO® a standalone Artificial Intelligence driven compliance chat bot, but she also offers 24/7 service and her knowledge base is programmed with the very latest from the FCA handbook, their papers plus other directives such as MiFID II, AML 4, SM&CR and the GDPR. Essentially, MO® is now empowered to perform a regulatory audit.

The FCA Business Plan '18/19

[fa icon="calendar'] Apr 10, 2018 1:57:30 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, FCAbusinessplan

The Financial Conduct Authority (FCA) yesterday published its Business Plan for 2018/19 that sets out the key priorities for the coming year.

The FCA, Digital compliance and benchmarking your performance

[fa icon="calendar'] Mar 28, 2018 5:25:01 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, ThomsonReuters,

This week we spoke at the Thomson Reuters Risk and Compliance Summit about the introduction of Artificial Intelligence to Compliance and Risk management.

The FCA Approach to Supervision and Enforcement

[fa icon="calendar'] Mar 23, 2018 11:54:23 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision

When the FCA launched its Mission, it committed to publishing a series of documents that would explain its approach to regulation in more depth. These articulate how the FCA carries out its main activities, aiming to provide transparency to its thought process and decision-making.