So, the FCA start the new decade with a bang by writing to all Retail Investment Adviser firms with their latest directives surrounding regulatory concerns and risks…

Dear CEO

[fa icon="calendar'] Jan 22, 2020 2:46:41 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, HRD, PII

A Christmas Compliance Ghost Story

[fa icon="calendar'] Dec 19, 2019 4:50:33 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, HRD, PII

The wind rattled the windows and the faint songs of carol singers could be heard as Ebenezer Scrooge huddled in his cold bed clutching a mug of hot water. “Bah Humbug” he exclaimed, “Christmas, a distraction from what is important…money and more money..” he barked to himself.

Dealing with a hard PII market

[fa icon="calendar'] Dec 6, 2019 10:36:14 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, HRD, PII

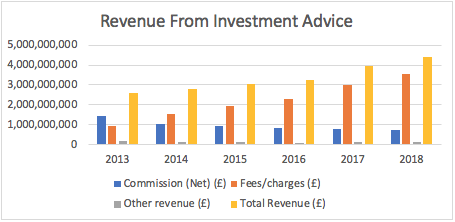

With nearly 300 financial advice firms telling the FCA their professional Indemnity Insurance (PII) cover for claims was non-compliant post the Financial Ombudsman Service (FOS) limit rise from £150,000 to £350,000 and reports of 300%+ increases in PII premiums post FCA DB pension transfer directives means the industry is now facing a real dilemma.

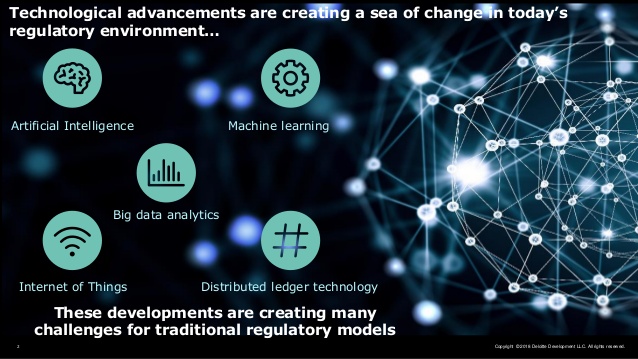

The Future of Regulation

[fa icon="calendar'] Nov 22, 2019 10:34:13 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, HRD

The FCA termed RegTech as “…a subset of FinTech that focuses on technology that may facilitate the delivery of regulatory requirements more efficiently and effectively than existing capabilities.” Simply put, RegTech can streamline compliance making it more effective and efficient plus provide tangible benefits such as cost and time savings.

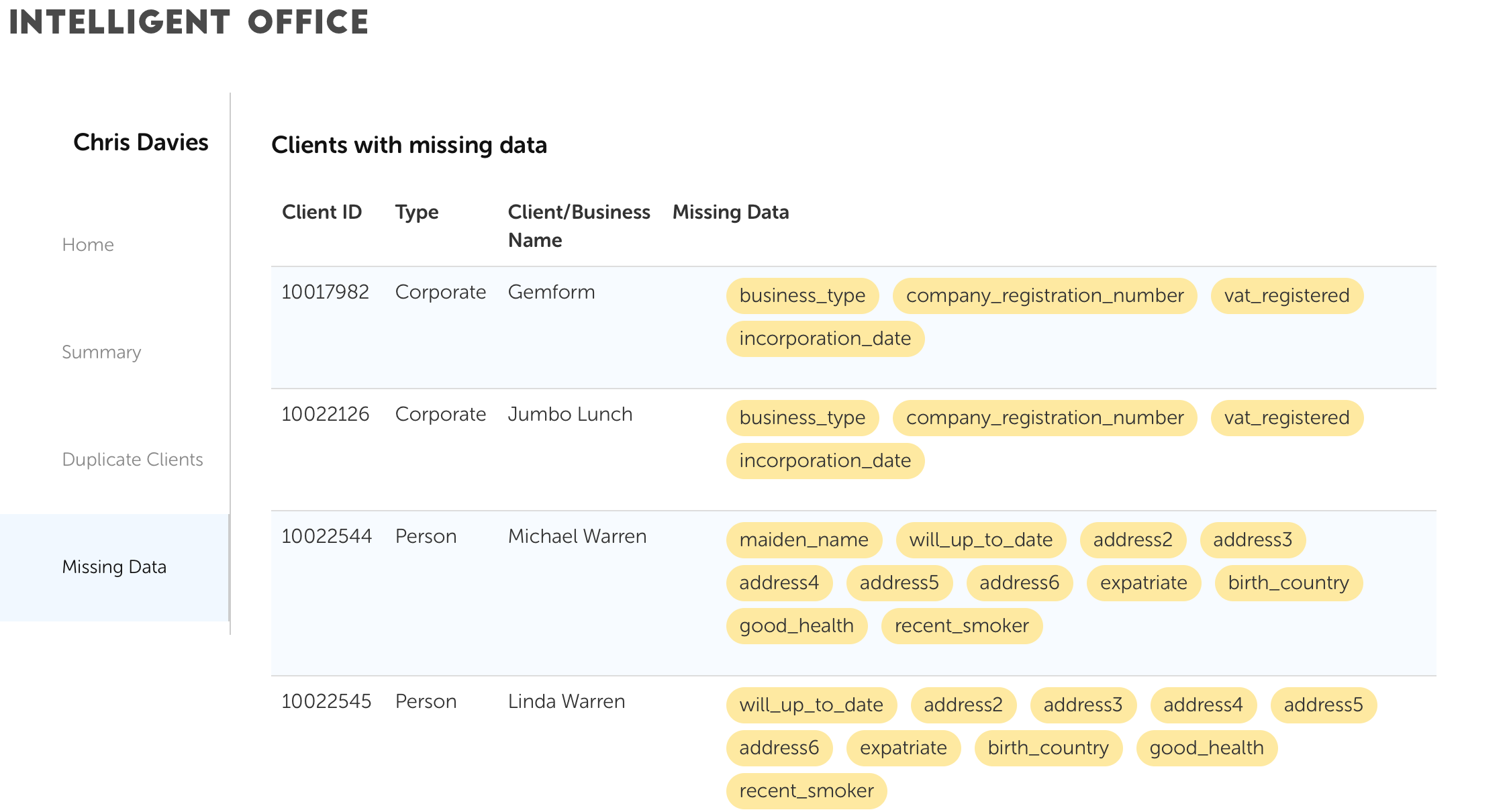

Your Data, Your Business, Your Clients

[fa icon="calendar'] Nov 8, 2019 11:21:50 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, HRD

One thing’s for sure, you’re only as good as the data you hold in your business. Rubbish in, rubbish out is the overused phrase, but it is so true when it comes to this digital age retail investment advisers now find themselves.

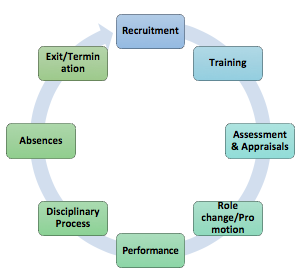

HR and The SM&CR

[fa icon="calendar'] Oct 25, 2019 12:10:34 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, HRD

With the new Accountability Regulatory Regime shortly upon us, what is apparent is that Retail Investment Adviser (RIA) firms, no matter how small they are need to ensure they have Human Resource Development (HRD) strategies and resources in place. We are currently running our SM&CR CPD accredited workshops for Intelliflo Regional Users Groups across the UK and the feedback is that some firm’s really need help and support around HRD and its new compliance functionality given the SM&CR.

Pension Transfers and Regulatory Risk

[fa icon="calendar'] Oct 16, 2019 3:44:31 PM / by Chris Davies posted in Financial regulation, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, Pension transfer

So the FCA have turned up the heat BIG time on pension transfers with their latest publications on transfer advice. The proposals aim to help consumers achieve better value from their pensions and to improve the quality of pension transfer advice.

59 Days to The SM&CR

[fa icon="calendar'] Oct 11, 2019 10:27:06 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

59 days to go until SM&CR day 9th December 2019. How are you getting on with your planning? Our tables below show you what should be covered and what you’ll need to keep under wraps on an on-going basis.

Improving advice suitability

[fa icon="calendar'] Oct 4, 2019 10:53:24 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

At the recent Money Marketing Interactive Conference Harrogate The FCA’s Debbie Gupta, Director of Life Insurance and Financial Advice Supervision, gave a speech on improving advice suitability and explored how the suitability of financial advice can be improved.

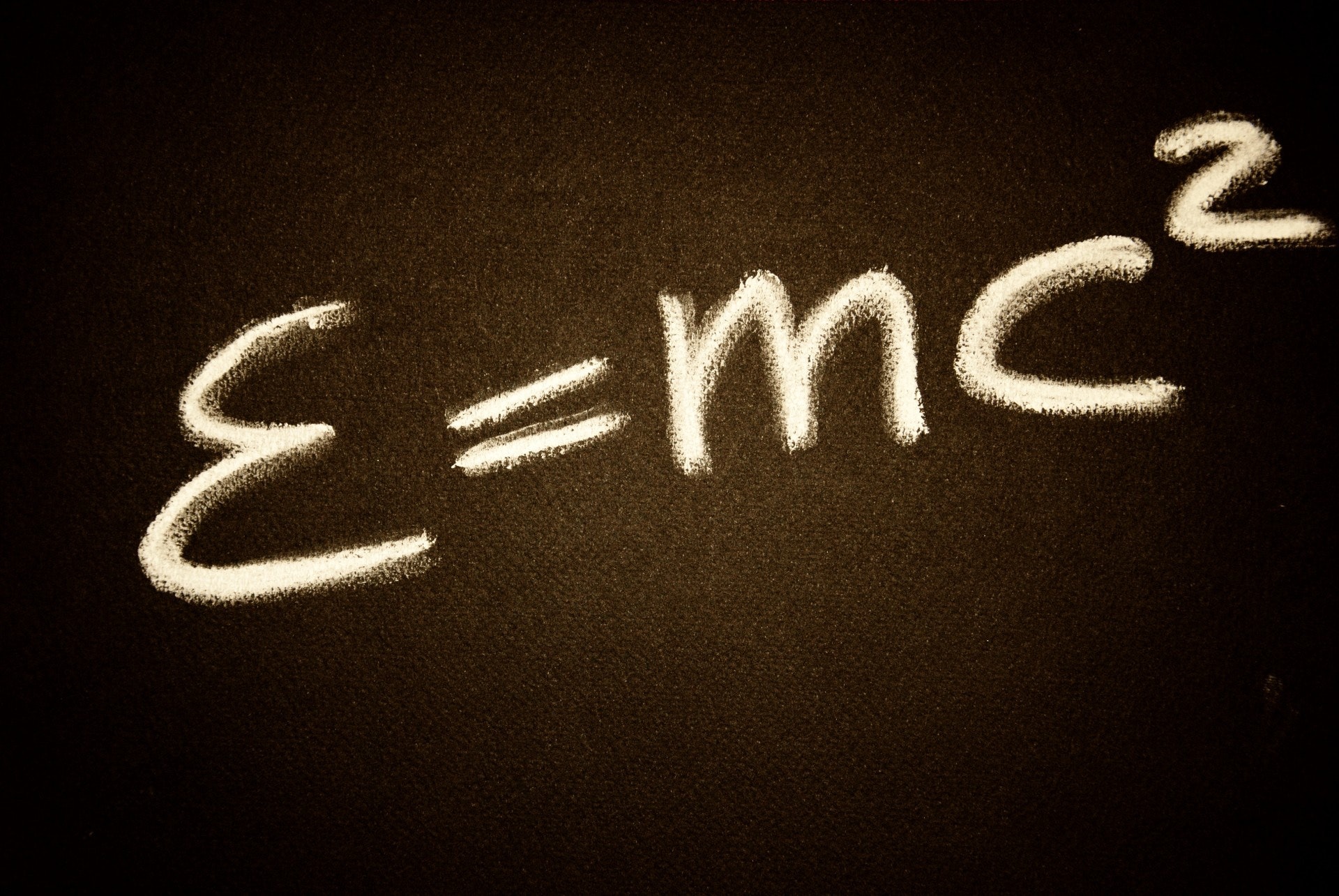

Applying Einstein thinking and RegTech

[fa icon="calendar'] Sep 13, 2019 10:44:26 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

Current compliance methods still tend to be reactionary and employ checklists and tick box approaches. This is like driving car through rear mirror and it just creates the same problems, as Einstein said we cannot solve problems with the same thinking used when we created them, so a move away from ‘swivel chair' compliance using disparate, tick box solutions to a joined-up journey requires different thinking which is pro-active and strategic in approach.