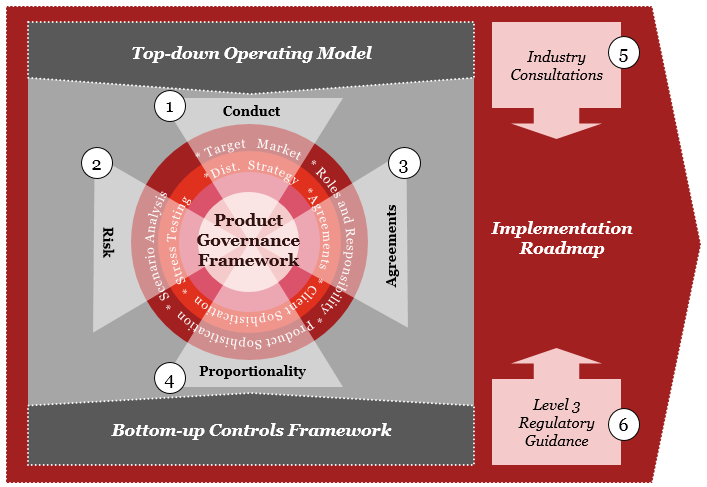

The missing link between advice suitability and appropriateness of product in meeting client needs was delivered for retail investment advice firms with the introduction of Product Governance and distribution rules i.e. PROD 3.3 in particular.

Why PRODing your clients is a good thing

[fa icon="calendar'] Aug 24, 2018 10:17:08 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance

Marrying Business and Compliance Risks

[fa icon="calendar'] Aug 17, 2018 1:30:30 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms

One of the biggest risks we see Retail Intermediary Advisers (RIAs) make is confusing compliance and business risk. For example, recommending a product that is deemed suitable to meet current client needs doesn’t make it a good risk when viewed from a business legacy viewpoint i.e. client circumstances change, their perceptions change thus their trust and informed consent is at risk if they are not serviced correctly and thus lost trust and complaints become a business risk via fines and damaged reputation or worse.

The FCA's Platform Probe

[fa icon="calendar'] Jul 19, 2018 4:34:52 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms

The FCA’s latest Platform ‘probe’ paper left many wondering if it really was worth the wait. No imminent platform price war is evident, yet this is another steppingstone in this new age of high regulatory accountability the industry now finds itself.

The FCA's new era of accountability and 5 conduct risk questions

[fa icon="calendar'] Jul 3, 2018 5:58:15 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability

Terminology is everything we hear, as the financial services industry seems to enjoy loading up on acronyms and jargon for simple processes. Just think of AER, CREST, Dematerialisation, Dirty price, FRNS, HICP – I could go on, so since the RDR (another one) we have been called to the transparency table. So where pricing and charges are concerned, for example, we have a need for clear and unambiguous charging delivered in simple terms.

The Luddite fallacy and the rise of Artificial Intelligence in Retail Financial Services

[fa icon="calendar'] Jun 15, 2018 2:19:44 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice, AI, Luddite

‘The luddites destroy the robots’ may make an attention grabbing headline, yet with all the hype around job losses caused by machine learning and Artificial Intelligence (AI) we need to gain some perspective on where we’re at and where we’re heading.

Unconscious bias and suitability conundrum

[fa icon="calendar'] Jun 1, 2018 9:47:02 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice

When Starbucks closes 8000 stores across the USA, you know there’s a problem. It was reported that due to staff’s unconscious racial bias two men were asked to leave and then arrested for ‘loitering’ in a Starbucks café when all they wanted was to buy a cup.

The FCA Streamlined Slap for Robo's

[fa icon="calendar'] May 23, 2018 10:23:55 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice

During our tour of the UK last year promoting our RegTech platform Model Office, we made it clear that those firms employing the poorly named Robo-Advice solutions really needed to employ research and due diligence on the technology before employing it within their business proposition.

Accountability, Fines or Prison: Your Choice

[fa icon="calendar'] May 11, 2018 3:16:53 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct

‘We strongly encourage firms and senior management to continue to focus on their conduct and culture and to ensure that good practice becomes embedded throughout their firm' The FCA 5 Conduct Questions April 2018.