Current compliance methods still tend to be reactionary and employ checklists and tick box approaches. This is like driving car through rear mirror and it just creates the same problems, as Einstein said we cannot solve problems with the same thinking used when we created them, so a move away from ‘swivel chair' compliance using disparate, tick box solutions to a joined-up journey requires different thinking which is pro-active and strategic in approach.

Applying Einstein thinking and RegTech

[fa icon="calendar'] Sep 13, 2019 10:44:26 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

Improve Your Compliance With Automation

[fa icon="calendar'] Aug 30, 2019 11:23:48 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

The FCA Accountability regime (Senior Managers and Certification Regime-SM&CR)brings a need for self-regulation. Senior Managers within Retail Investment Advisers (RIAs) and Wealth Management firms will need to ensure they can prove that they have their finger on the pulse for Governance, Risk and Compliance within their businesses.

Compliance summer chill and clean

[fa icon="calendar'] Jul 26, 2019 12:12:16 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

It’s hot out there and with summer time here with a bang and we hope you’re keeping cool and on top of business matters. Indeed with holiday season upon us, it’s a great time for wealth manager and adviser firms to employ RegTech allowing them to take a step back and ‘Summer clean’ their business across some key regulatory issues such as Risk management, Data quality and management information (MI):

The PFS Roadshow and SM&CR

[fa icon="calendar'] Jul 12, 2019 8:59:35 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

Well it’s been a hectic 3 weeks on the road around the UK with the Personal Finance Society (PFS). We have been privileged to meet over 1000 adviser and wealth management business owners and their staff all who are working hard on their business and with their clients and want to learn more about professional practice.

Key Regulatory Readiness Themes

[fa icon="calendar'] Jul 5, 2019 10:58:39 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

We have now enjoyed exhibiting and speaking on RegTech at 6 of the 26 Personal Finance Society (PFS) Regional events. They seem to attract high quality delegates from the retail investment advice sector and are extremely well attended throughout each day

The Science of Compliance

[fa icon="calendar'] Jun 28, 2019 11:13:17 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

One area that has always never failed to amuse me is the saying that the trouble with opinions is everyone has got one!

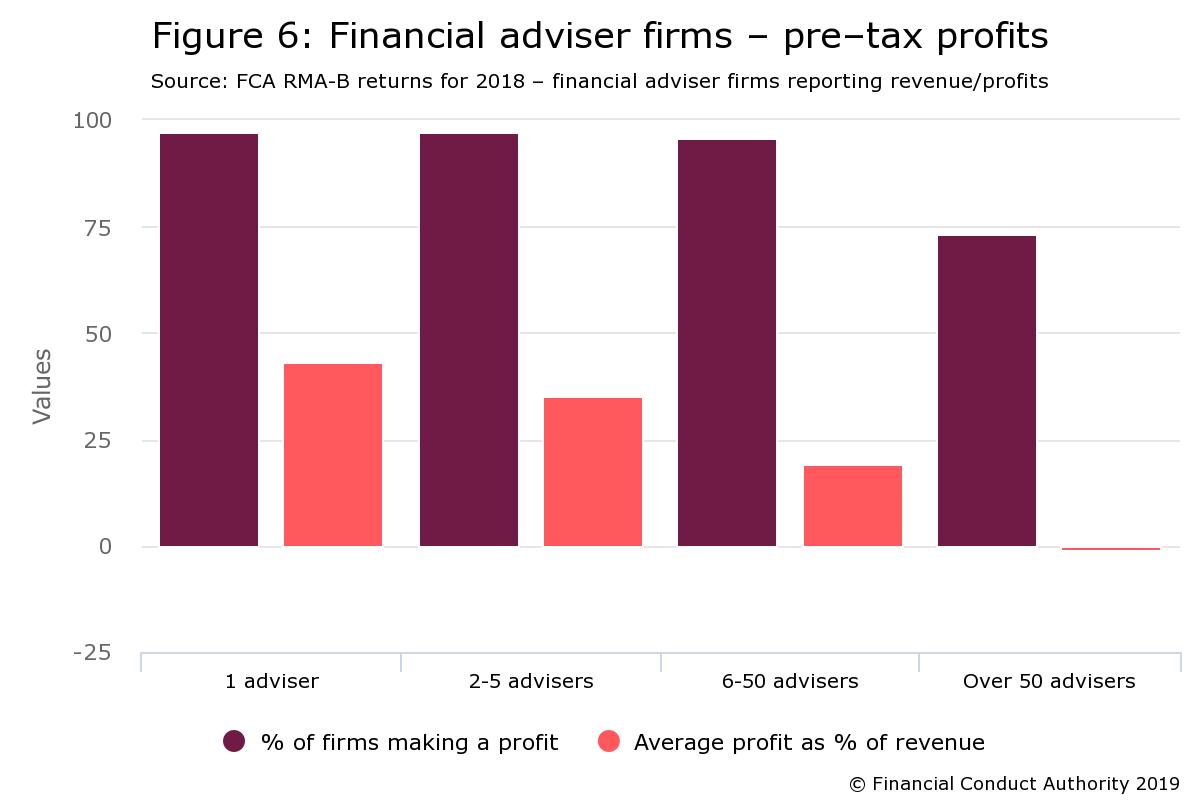

FCA Data Bulletin

[fa icon="calendar'] Jun 21, 2019 12:31:46 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

With the retail investment adviser (RIA) market now under severe scrutiny via the FCA’s accountability regime, their latest Data Bulletin focused on 2018 RMAR driven data analysis across revenues, profitability, number of firms, capital resource, Professional Indemnity Insurance (PII) premiums and advice type and revenue from adviser charges.

Are You Prepared For A Regulatory Visit

[fa icon="calendar'] Jun 14, 2019 2:17:04 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

We’ve written extensively about the new FCA accountability regime and with the recent FCA Dear CEO letterto the SIPP market in October last year, it has now emerged, thanks to a Professional Adviser freedom of information request that 11 SIPP firms have been paid a visit.

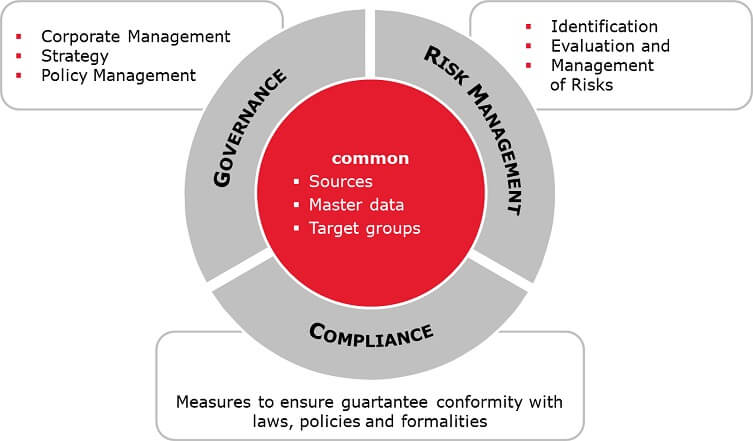

Governance Risk and Compliance

[fa icon="calendar'] Jun 7, 2019 10:07:00 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

With Model Office’s recent business trip to Australia in mind, this week we focus on how the new era of accountability within financial services seems to be sweeping through regulatory authorities world wide like wild fire.

The SM&CR and consequences of non-compliance

[fa icon="calendar'] May 17, 2019 11:57:56 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

Any one heard of the SS Eastland? No, thought not, well this was a ship built in the same guise as the Titanic and suffered MORE passenger deaths due to unintended consequences of regulations. The ship toppled over in Chicago harbor due to the fact it had complied with the Laffollette’s Seaman’s act 1915 and that applied to each ship having enough lifeboats for its passengers. The problem? The increased number made the Eastland top heavy, it rolled to its side killing 844 passengers compared to the Titanic’s 818.