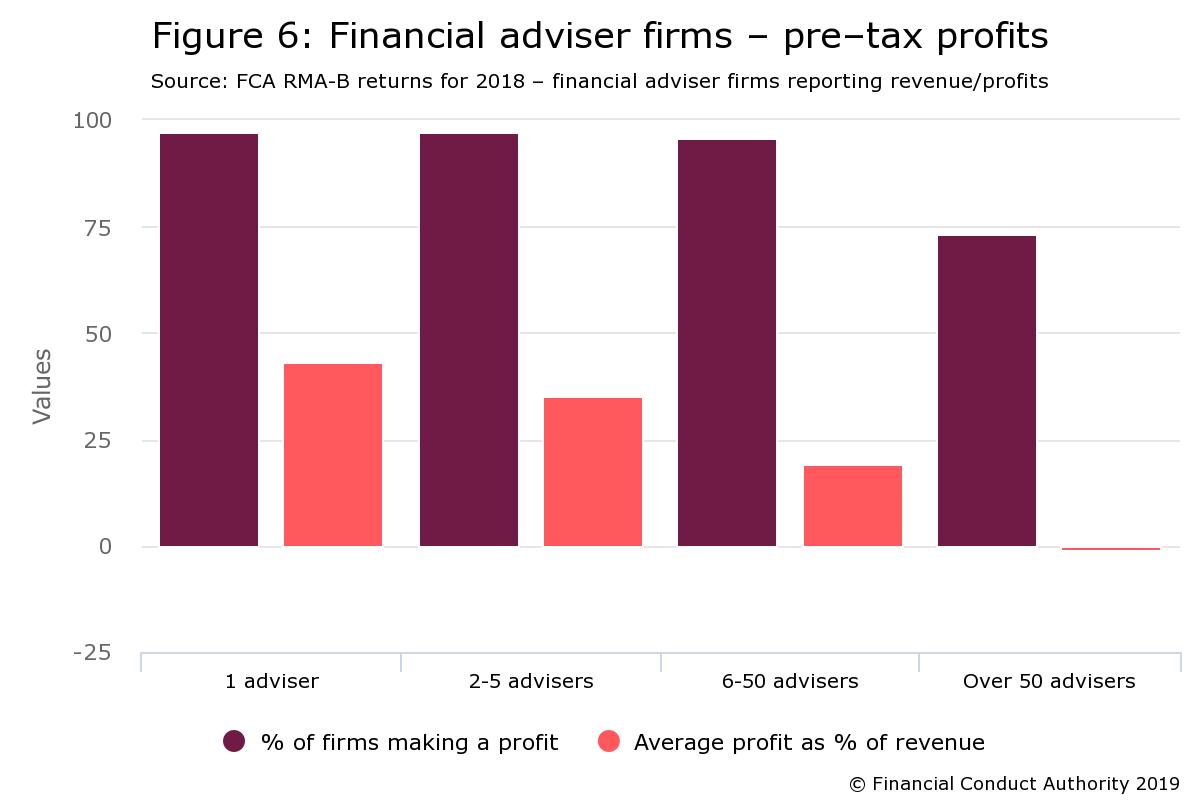

With the retail investment adviser (RIA) market now under severe scrutiny via the FCA’s accountability regime, their latest Data Bulletin focused on 2018 RMAR driven data analysis across revenues, profitability, number of firms, capital resource, Professional Indemnity Insurance (PII) premiums and advice type and revenue from adviser charges.

FCA Data Bulletin

[fa icon="calendar'] Jun 21, 2019 12:31:46 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

Are You Prepared For A Regulatory Visit

[fa icon="calendar'] Jun 14, 2019 2:17:04 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

We’ve written extensively about the new FCA accountability regime and with the recent FCA Dear CEO letterto the SIPP market in October last year, it has now emerged, thanks to a Professional Adviser freedom of information request that 11 SIPP firms have been paid a visit.

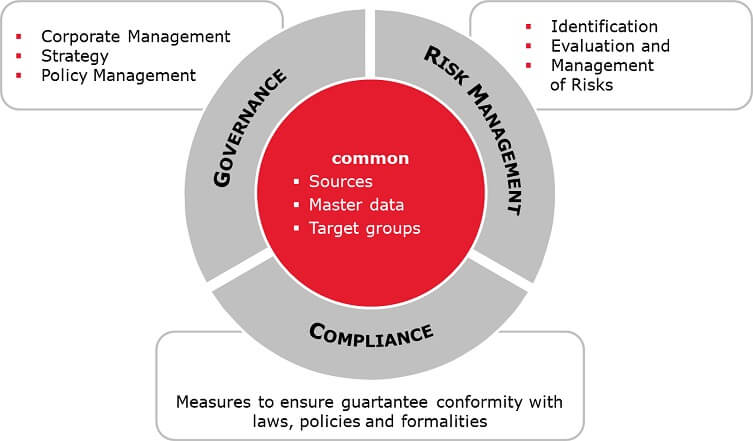

Governance Risk and Compliance

[fa icon="calendar'] Jun 7, 2019 10:07:00 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

With Model Office’s recent business trip to Australia in mind, this week we focus on how the new era of accountability within financial services seems to be sweeping through regulatory authorities world wide like wild fire.

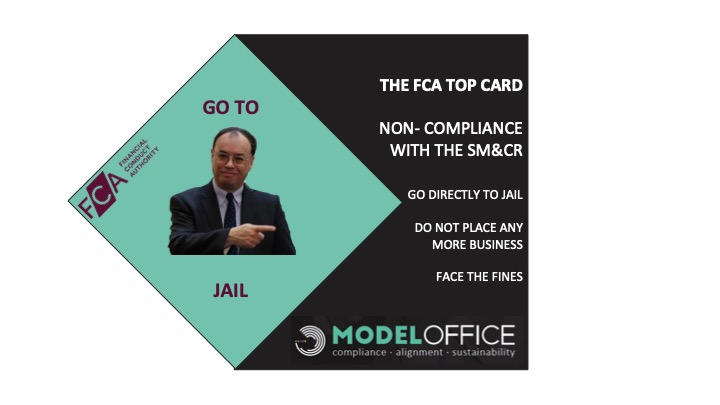

The SM&CR and consequences of non-compliance

[fa icon="calendar'] May 17, 2019 11:57:56 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

Any one heard of the SS Eastland? No, thought not, well this was a ship built in the same guise as the Titanic and suffered MORE passenger deaths due to unintended consequences of regulations. The ship toppled over in Chicago harbor due to the fact it had complied with the Laffollette’s Seaman’s act 1915 and that applied to each ship having enough lifeboats for its passengers. The problem? The increased number made the Eastland top heavy, it rolled to its side killing 844 passengers compared to the Titanic’s 818.

How do you know you are compliant?

[fa icon="calendar'] May 10, 2019 9:55:05 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

Such a loaded questions isn’t it? Yet this is a crucial question we always ask when meeting retail investment adviser firms in the market place. Compliance, as financial advice, is not an exact science and is heavily nuanced and sensitive given the amount of rules and regulations firms are contending with against the background of the FCA’s principle based framework.

The FCA 2019/20 Business Plan and RegTech

[fa icon="calendar'] Apr 26, 2019 12:36:58 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

The FCA published its Business Plan 2019/20 on 17 April 2019, setting out 8 cross-sector priorities, as well as seven priorities for specific regulated sectors. The plan outlines the FCA’s priorities for the year ahead and describes its response to identified issues, covering supervisory priorities as well as market studies and the policy work the FCA plans to undertake through the course of the next 12 months.

The SM&CR Unintended consequences

[fa icon="calendar'] Mar 15, 2019 10:51:51 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting

We have written extensively about the SM&CR being the most personally impactful pieces of regulation to hit retail financial services industry in decades, yet what is also apparent is there are some unintended consequences that the industry needs to address and include in their implementation processes.

2019: The Year of Regulatory Accountability

[fa icon="calendar'] Jan 4, 2019 3:47:09 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, SMCR, Data, GDPR, Chatbot, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, Modeldrivenmachineexecutablerporting, digital,, Regulatory, Reporting, BREXIT

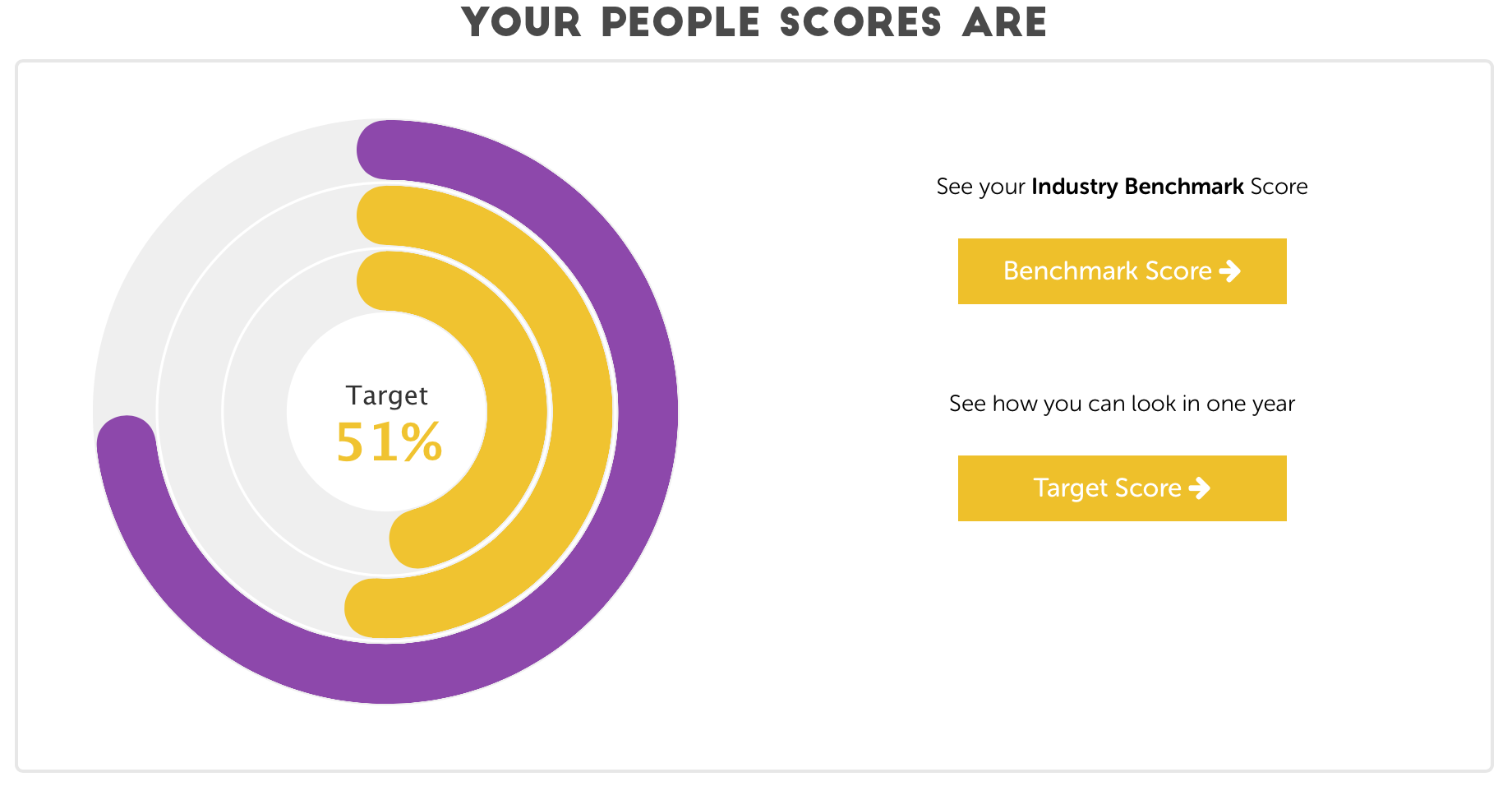

The SMCR and Emotional Intelligence–Model Office-MO Key 5: Your People

[fa icon="calendar'] Nov 24, 2017 4:07:37 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, suitability, FAMR, MiFIDII, SMCR, Data, Systems and controls

MO’s 5 keys act as your compliance and professional development foundations so you can map and self-audit your journey as a professional practice, to ensure you not only meet the regulatory rules: TCF, KYC, Suitability, MiFIDII, GDPR, SMCR but also benchmark against the FCA papers and good outcomes they covet and also track performance against your peers.

Building the case for constructive compliance

[fa icon="calendar'] Sep 21, 2017 3:58:00 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, SMCR

With The FCA now focusing on the implementation of MiFIDII plus with the SMCR and GDPR also on the way, we are now seeing far more focus on transparency, accountability, roles and responsibilities.