The recent FT Adviser article regarding government led changing compliance rules highlights a major shift in corporate criminal liability. With the Economic Crime and Corporate Transparency Act 2023 already broadening attribution rules, the proposed 2025 Crime and Policing Bill pushes accountability even further — from economic crime to health, safety, environmental, and data offences. The direction of travel is clear: corporate liability now attaches not only to intent but to ordinary management decisions made under pressure.

Chris Davies

Recent Posts

Culture, compliance and expanding the line of fire

[fa icon="calendar'] Nov 11, 2025 12:58:12 PM / by Chris Davies posted in Financial regulation, fintech, client engagement, regtech, Risk management, practice management, FCA, Data, compliance, consumer duty

Innovation needs to be at the heart of the 'Leeds regulatory reforms'

[fa icon="calendar'] Jul 17, 2025 10:18:10 AM / by Chris Davies posted in Financial regulation, fintech, client engagement, regtech, Risk management, practice management, FCA, Data, compliance, consumer duty, Mansion house speech

Chancellor Rachel Reeves’ dramatic Leeds Reforms, unveiled in Leeds and followed by her Mansion House speech on 15 July 2025, could mark the most comprehensive overhaul of the UK financial regulatory landscape in over a decade (GOV.UK). But, the Chancellor needs to get the balance right in cutting red tape and managing inherent risks. As the FT writes; ' This is particularly important for her plans to reform the senior managers’ regime, the Financial Ombudsman Service — an arbiter of complaints between consumers and the industry — and ring fencing rules that force banks to separate their retail and investment banking activities. Some measures could also backfire. An initiative to enable banks to extend mortgages to individuals on lower incomes, however well meaning, risks pushing UK house prices even higher as housebuilding continues to drag.' (FT)

Preparing your data for FCA data information requests

[fa icon="calendar'] Jun 16, 2025 3:47:59 PM / by Chris Davies posted in Financial regulation, fintech, client engagement, regtech, Risk management, practice management, FCA, Data, compliance, consumer duty

As the financial advice landscape continues to evolve and advice firms having to adapt by adopting technology, they are under increasing pressure to demonstrate not just the value of their services, but also the quality and governance behind them. Recent industry trends highlight several areas where firms can focus their efforts to remain resilient, client-centric, and operationally strong.

2025 Regulatory Horizon Scan

[fa icon="calendar'] Jan 3, 2025 12:27:53 PM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source, Horizon scan

As we embark on 2025, the UK financial landscape is poised for transformation, with the Financial Conduct Authority (FCA) leading the way. In this blog post, we'll delve into key regulatory topics proposed by the FCA for the year ahead. For an FCA view on their regulatory pipeline, you can view their Regulatory Initiatives Grid here.

Christmas Magic: How AI is streamlining Compliance

[fa icon="calendar'] Dec 13, 2024 10:25:06 AM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source

As the festive season envelops us in tinsel and cheer, compliance officers in UK financial services are decking the halls with more than just holly. This year, they're unwrapping AI-powered tools that make regulatory compliance as smooth as a sleigh ride. Let's explore three innovative AI developments that are transforming compliance activities, all with a sprinkle of Christmas spirit.

The FCA's October 2024 Dear CEO letter: Directives for Financial Advisers: A Data-Driven Future

[fa icon="calendar'] Oct 7, 2024 3:32:25 PM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source

The Financial Conduct Authority (FCA) has issued its latest directives aimed at financial advisers and investment intermediaries, emphasising the importance of a proactive, data-driven approach to ensure regulatory compliance and deliver better outcomes for clients. This blog outlines the FCA’s Dear CEO letter priorities and how firms can adapt to meet these expectations effectively.

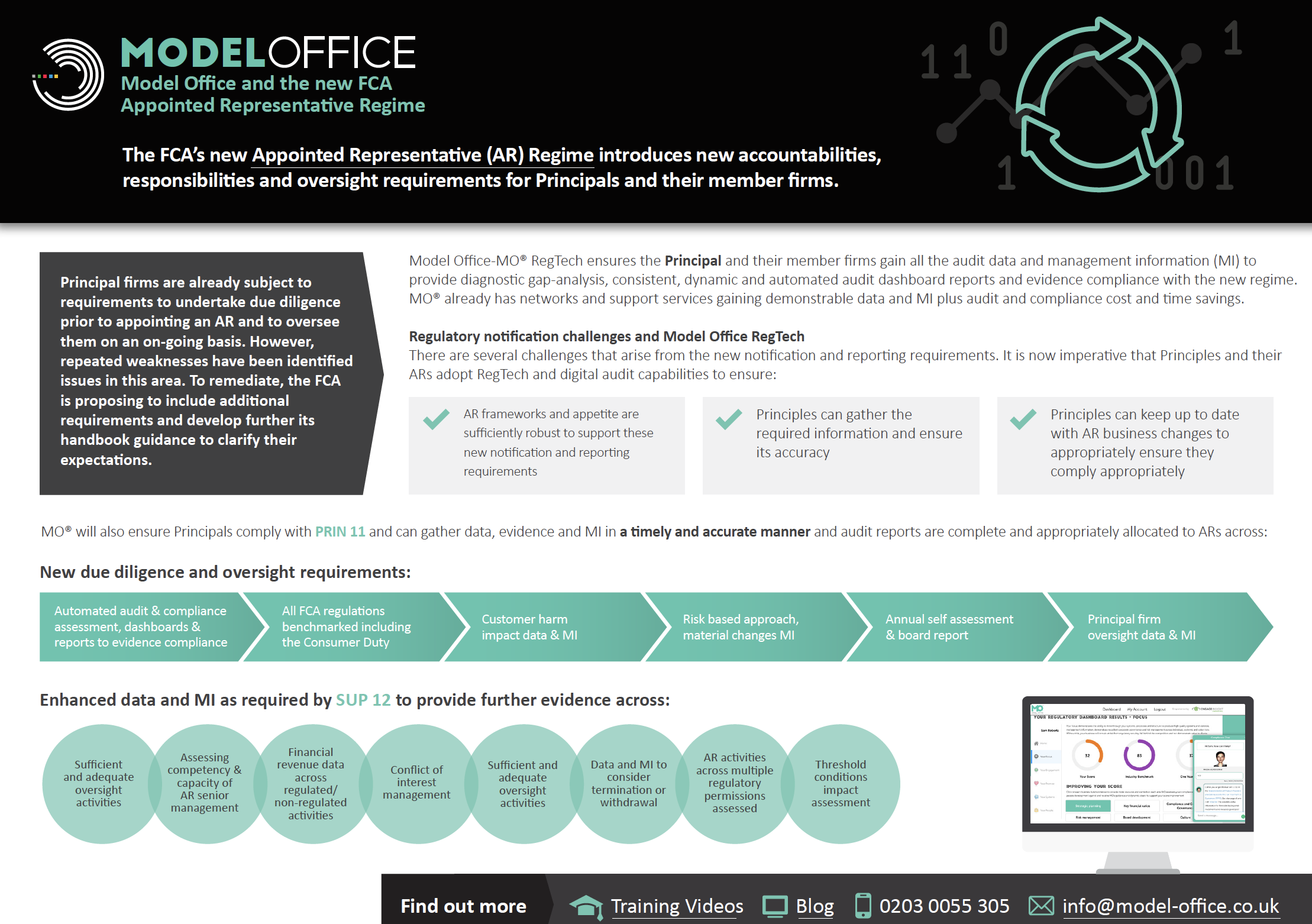

Ensuring Effective Oversight of Appointed Representatives: Key Compliance Insights for Principal Firms

[fa icon="calendar'] Sep 10, 2024 10:11:02 AM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source

The Financial Conduct Authority (FCA) recently published new guidance on how principal firms should embed new rules to ensure effective oversight of Appointed Representatives (ARs). The updated regulations are designed to address risks in the AR regime, ensuring that consumers are adequately protected and that markets operate with integrity. Given the telephone interviews and questionnaires findings, that there are still significant gaps in oversight, the application for data led strategies and some principal firms are suffering from overconfidence in how well they are implementing these rules, it’s essential to understand these new requirements and how they impact the role of a principal firm.

Captain Scarlet and the Future of Regulation

[fa icon="calendar'] Jul 5, 2024 10:45:51 AM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source

We were fortunate to present to The Investment Network last week on the future of regulation, covering key themes retail financial advice firms need to factor into their governance, risk and compliance (GRC) activities, against a thematic backdrop of sci-fi films.

Apple's Gen AI Integration: A Game-Changer in Tech Dominance

[fa icon="calendar'] Jun 11, 2024 10:31:49 AM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source

Apple has taken a major leap in integrating artificial intelligence into its ecosystem with the upcoming iOS 18, iPadOS, and macOS updates. Here's a rundown of what you can expect:

The Open vs Closed Source AI Debate: Which is Right for Your Business?

[fa icon="calendar'] May 14, 2024 10:23:52 AM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source

In the ever-evolving landscape of artificial intelligence (AI), a critical distinction exists between open source and closed source AI. Whilst there is plenty of white noise regarding the pros and cons on AI and digital tools, understanding the open and closed source concepts is pivotal for developers, businesses, and enthusiasts aiming to leverage AI and digital strategies effectively.