The FCA’s Final Guidance assessing adequate financial resources places a specific spotlight on retail investment adviser firm’s (RIA’s) financial resilience. The minimum standards the regulator uses to protect consumers, reduce market disruption and minimise harm and assess firm’s sustainability are called threshold conditions.

Threshold conditions and Financial resilience

The assessment of appropriate resources under threshold conditions considers:

- the nature and scale of a firm’s business model

- the risks to the continuity of the services provided

- the impact of other members of the firm's group on the adequacy of its resources

- To assess if a firm has adequate financial resources, we consider if a firm:

- has the ability to meet its debts when they fall due

- For firms, other than those with limited consumer credit permissions, we also consider if a firm has:

- taken reasonable steps to identify and measure its risks

- appropriate systems and controls and human resources to measure risks prudently at all times

- access to adequate capital to support the business, and that client money and custody assets are

- not placed at risk

- resources which are commensurate with the likely risks it faces

With a pandemic to manage through, the FCA are obviously concerned at firm’s who sit outside formal prudential standards for adequate financial resources, for instance Internal Capital Adequacy Assessment Process (ICAAP) requires banks boards to regularly assess and mitigate risks and ensure adequate financial capital is retained to manage these risks.

So, we now have a framework that requires RIAs to implement and evidence Governance, Risk and Compliance (GRC) strategy to assess and manage across:

Systems, controls, governance and culture: Here the FCA are interested in conduct i.e. behaviours that drive good outcomes across the firm’s purpose, competent leadership, staff competence and incentives. Plus, employ sound risk management across systems and controls such as whistle blowing or complaints handling. What drives all this is individuals accountability and responsibility, something RIAs should have addressed under the Senior Managers and Certification Regime (SM&CR)

RIAs are also now expected to employ a system to identify, monitor and manage risks and employ a quantified risk appetite strategy which is communicated, understood and followed across the firm. Policy and procedures are then required to ensure the risk function is resourced, has appropriate controls, manage conflict of interests and outsourcing risks.

Identify and assess the impact of harm: Here RIAs should place a specific focus on conduct and competence, ensuring the right people are in the right place with the right skills and responsibilities. Firm’s need to ensure they can compensate consumers for losses and thus the issue of the Financial Services Compensation Scheme (FSCS) and ability to fund applies here. It’s worth noting that the majority of payments made by the FSCS is against solo regulated firms are those firms not subject to detailed prudential standards discussed above.

Continuity of service is also a key area and thus RIAs need to evidence investment in people, processes, systems and controls. Advice suitability is front and centre here, particularly around pension transfers for example.

Monitor and manage the potential depletion of financial resources: As I have written extensively on the need for RIAs to balance their charging strategy and move away from the industry wide reliance on ad-valorem charging to client paid fees, the issues we have witnessed during adverse market conditions such as the financial crises and current Covid19 means that there is a risk of depletion of income that can adversely affect the firm’s financial stability. Firm’s need to keep clients close, box clever and shift a percentage of fees to direct charging. This can stabilise cashflow in the short and long term.

Business model strategy and sustainability: Whenever I speak at public events, I tend to ask the question how many firms have a bonafide 10-year busines plan. Very few put their hands up! Just as it is so important for clients to have a long-term financial plan, RIAs need to employ a strategic plan that can ensure strengths, weaknesses, opportunities and threats are covered, stress testing is in place and all staff are aligned to this company strategy. This will ensure the FCA have confidence is RIA ability to manage financial resilience across the business and their client needs.

Wind down planning: Preparing for worst case scenarios is crucial, after all, it is those adviser firms who ensure their clients have adequate life insurance who are providing a holistic service, so RIAs also need to ensure that their business strategy incorporates their own demise if this is an unavoidable outcome of the pandemic.

How can firms deal with all this?

We need to avoid overwhelm and ensure firms continue to conduct the good work they are doing, so here we would argue that risk diagnostic assessments can help to ensure GRC strategy incorporating operation and financial resilience activities.

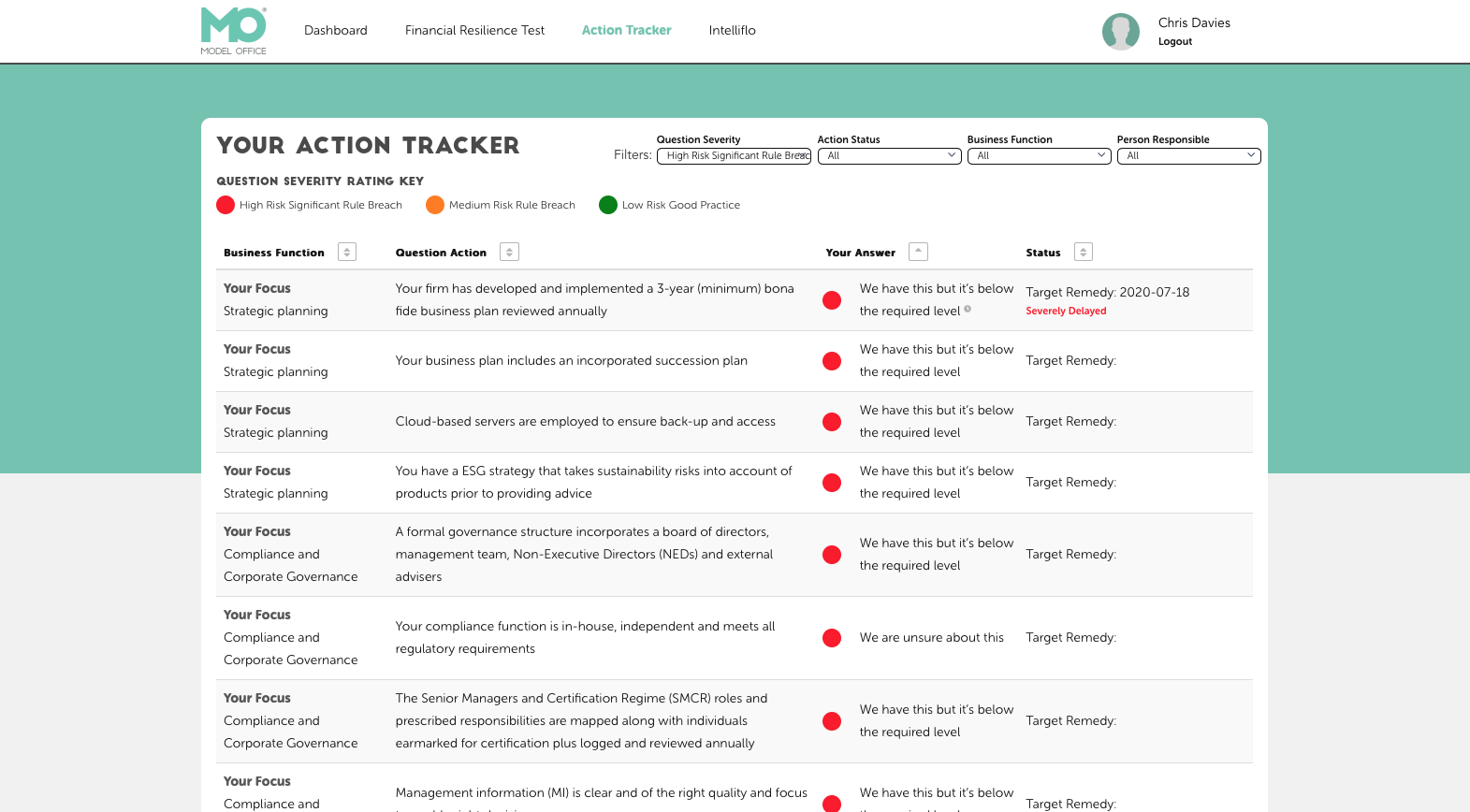

So, employing technology is a good start, this can ensure RIA’s gain specific management information and data to ensure their business resilience strategies are aligned to their rules and also to their clients and stakeholder needs. At Model Office for example, we have made our Financial Resilience Diagnostic free of charge so firms gain heat mapped dashboards and assess the strengths of their firm’s financial ratios and cashflow. You can sign up and download it for free here.

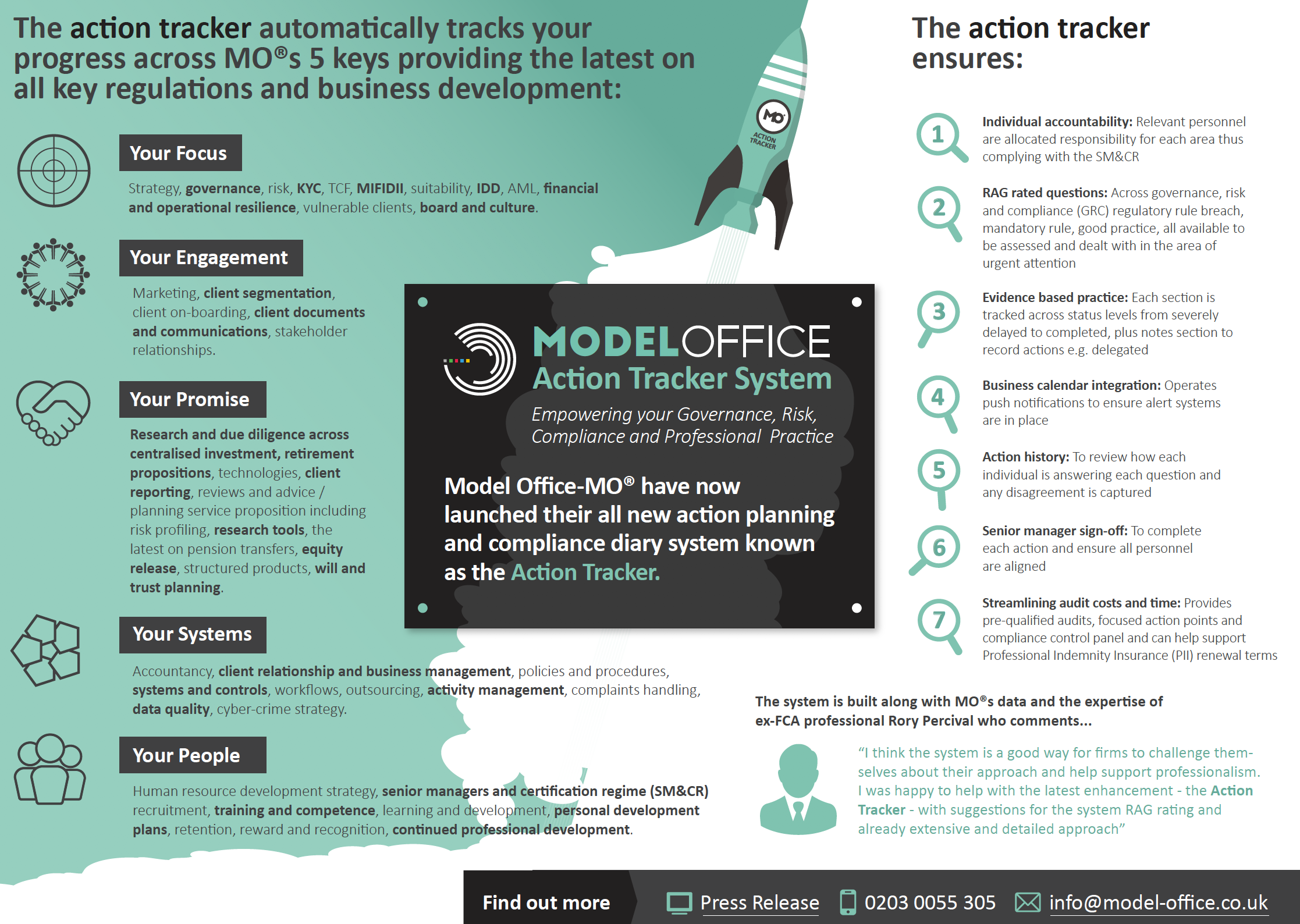

We have also developed an Action Tracker, Compliance Diary system that allows firms to automate audit actions and provides alerts to ensure stuff gets done and identify, manage and monitor risks.