As market participants across the distribution chain now grapple with the next deadline (30th April ’23) for product manufacturers to have clear communications and information provided to adviser (distributor) firms for them to meet the Duty obligations, they should look to one of the cross-cutting rules to help them gain context for what the regulator requires when it comes to data and information for Consumer Duty compliance.

Foreseeable Harm, the key to Consumer Duty compliance

[fa icon="calendar'] Jan 10, 2023 12:13:20 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, consumer_duty

The Consumer Duty Final Countdown

[fa icon="calendar'] Sep 30, 2022 3:10:27 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, Consumerduty

With our research showing only 1 in 4 firms taking action on the Consumer Duty and a month to go until the first October 31st deadline, it is probably worth retail advice firm’s sense checking where they are and what they need to do to ensure they have plans in place to assess their competence against this all-encompassing regulatory framework.

The Consumer Duty Final Rules and your data

[fa icon="calendar'] Jul 27, 2022 9:35:47 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, consumer duty

So, the final rules are here and not much has really changed other than the implementation period has been extended slight for live business to July 31st, 2023, and closed book business has until 31st July 2024. Plus (wait for it) firms need to be up and running on their implementation by October ’22! Although any extension is welcome, it’s not long enough in my opinion given the ramifications this all-encompassing regulatory directive brings. Think Operational Resilience which has an implementation and transitional period totalling four years!

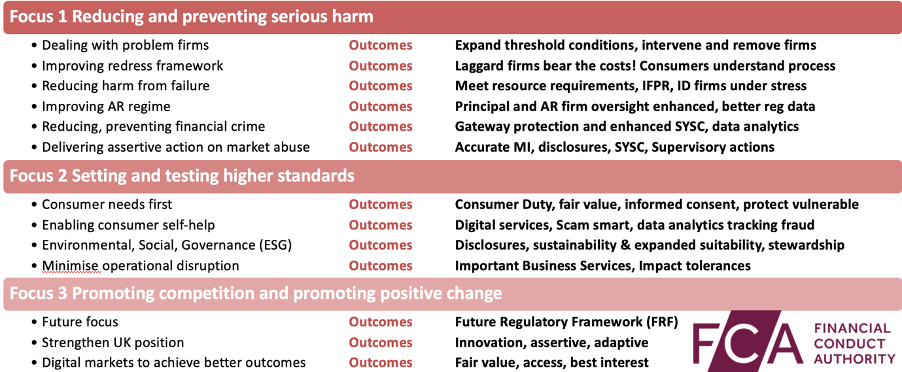

The FCA business plan 2022/23 and your data, data, data

[fa icon="calendar'] Apr 20, 2022 10:56:00 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, FCA, Analytics

When they are not on strike, the FCA are producing promising work. Their new business plan and focus on metrics and outcomes is a case in point. This business plan takes a new form in that it is hosted digitally on a webpage which provides hyperlinks to other relevant resources such as their three-year strategy and excellent Regulatory Initiatives Grid.

Improving the Appointed Representatives Regime Consultation Paper CP21/34 and the need for #RegTech

[fa icon="calendar'] Jan 21, 2022 10:02:22 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, appointedrepresentatives

With the latest FCA consultation paper for improving regulatory oversight of the Appointed Representative Regime, without a cohesive, coordinated approach, Principle firms governance, risk and compliance (GRC) systems and control audit resources may not be deployed effectively and significant risks maybe missed. This can lead to mis communications and dysfunctions within the Principal firm internal GRC practice, poor reporting, market risk and poor consumer outcomes across AR activities. With the FCA’s new proposals, based on a background of poor consumer outcomes at the hands of ARs, Principals and their ARs now need to employ RegTech to gain clear and accurate data analytics across all activities to ensure they comply in order they can continue to compete. This blog looks at the key themes and how RegTech can support Principal firms and their ARs.

Social distancing does not mean social isolation

[fa icon="calendar'] Mar 10, 2020 1:16:08 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAMR, MiFIDII, SMCR, Data, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, HRD, PII

Having lived through Severe Acute Respiratory Syndrome (SARS) in Hong Kong I seem to have a deja vu with COVID-19 and social distancing upon us as we move towards a period of uncertainty where the most basic of human instincts, connecting face to face to learn and explore collaboration may be curtailed for a number of weeks or even months. We are running a webinar on this Friday 20th 11am which you can sign up for here

So here are our thoughts on how to move forwards with composure, integrity and transparency.

The world we operate in is full of risks and risk management is a pre-requisite now for firms to survive and thrive and showcase professional practice. The FCA define risk as ‘the combination of impact (potential harm caused) and probability (likelihood of issue or event occurring)’.

There are significant benefits to risk management:

- Improve governance across compliance, conduct, competency

- Increase the likelihood of achieving the organisation’s goals

- Provide assurance and stakeholder confidence and trust

- Establish a reliable basis for decision making and planning

- Improve organisational resilience

- Effectively allocate and use resources for risk treatment

- Establish enhanced decision-making which in-turn will provide benefits by way of improvements in the efficiency of organisational operations, effectiveness of tactics (change processes) and the efficacy of the overall organisational strategy

Where a national and global health and financial challenge is concerned firms now should:

- Focus on engaging their clients and re-assuring them that services and portfolios are risk assessed, managed and monitored

- Re-assure staff and follow NHS guidance on cleanliness of premises and social distancing

- Employ RegTech to ensure they identify, manage and monitor risks across the business plus using technology will minimise interpersonal interaction

Once completed, firms can then better assess a way forward with their business and clients across:

- Review a strategy for individual contact for example it could be wise to cease handshaking, keeping a distance and limit close social contact and ensure any staff or clients with a fever, cold or flu symptoms stay home. We’re advocating the Vulcan greeting; ‘Live Long and Prosper’

- Ensure the principles of individual cleanliness are communicated such as hand washing and not touch your eyes, nose or mouth, plus read up on WHO Q&A

- Design and employ a triage strategy when engaging clients to find out if a meeting is necessary or not. Advisers can then contact the client and assess how best to help the client

- Once triage is completed engage clients through virtual technology such as Skype, Zoom, Join.me and running online reviews and meetings plus use FinTech applications such as Client Portals, Cash flow modelling or Robo-Advice

- Develop content led syndication across social media, blogs, opinion pieces, video to re-assure clients

- Work smart with staff working from home as necessary or developing shifts to minimise travel and personal interaction for staff and use webinar tech to hold team or conference meets.

- Support home working by offering guidance around daily work routine and engagement, mental fatigue and anxiety management, support tools such as computers, cellphones and webex access

- If consultants or Non-Exec Directors are employed then their engagements need to be assessed and a view taken on whether they need to self isolate for 14 days before returning having visited other 'at risk' premises.

Along with SARS, COVID-19 requires a sensible and practical strategy. Business as usual should continue until we hear otherwise, but by applying some tweaks to existing practice as above will provide re-assurance to your staff and your clients.

Live Long and Prosper...

Retail Investment Adviser Benchmark Study 2020

[fa icon="calendar'] Mar 6, 2020 9:29:50 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, FAMR, MiFIDII, SMCR, Data, Culture, Enforcement, supervision, audit, Conduct, AI, Risk,, Accountability, Platforms, PROD, Product governance, digital,, Regulatory, Reporting, HRD, PII

We have now launched our second bi-annual industry benchmark report which focuses on the key trends and challenges that retail investment advice firms face.

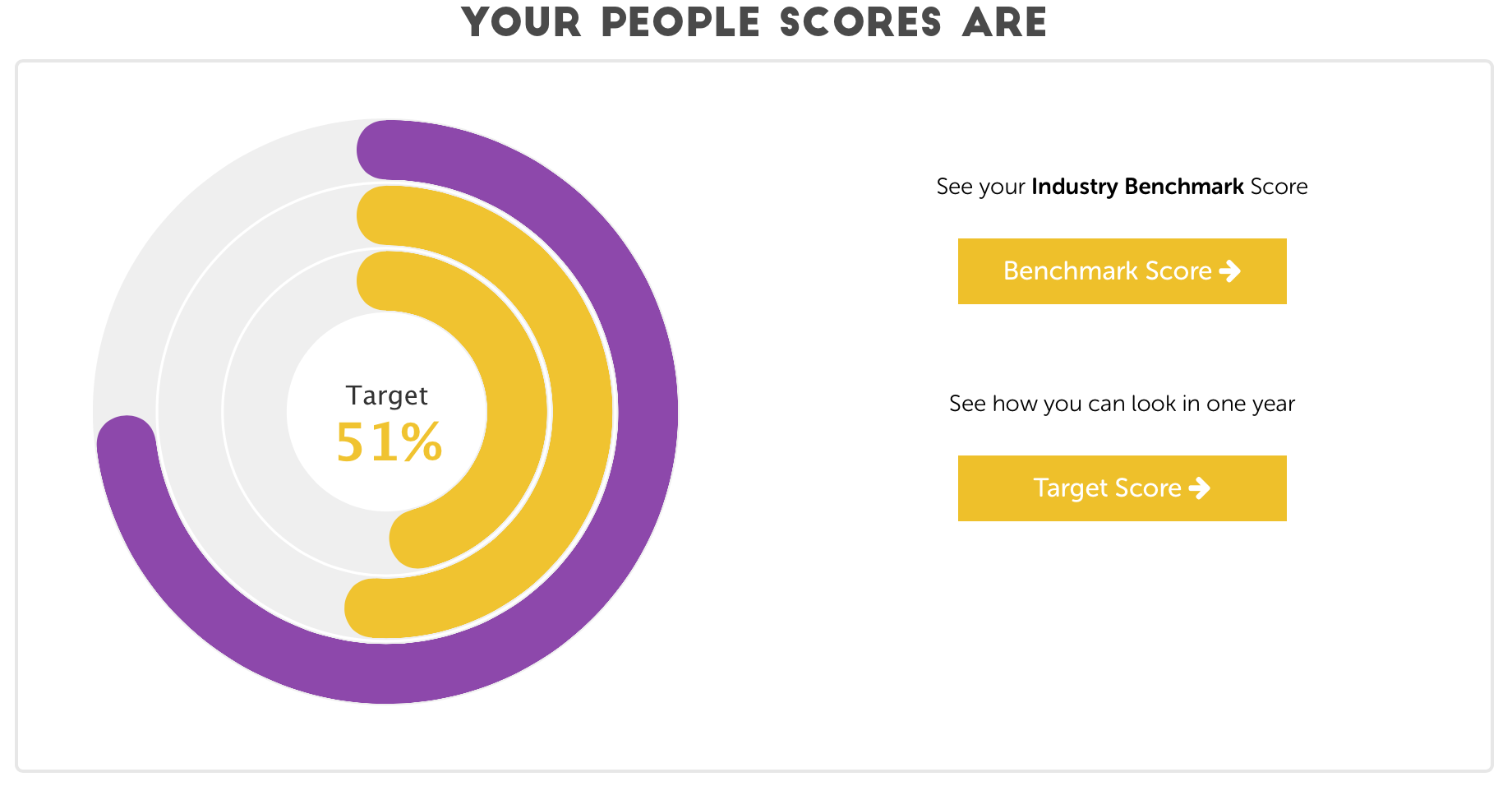

The SMCR and Emotional Intelligence–Model Office-MO Key 5: Your People

[fa icon="calendar'] Nov 24, 2017 4:07:37 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, suitability, FAMR, MiFIDII, SMCR, Data, Systems and controls

MO’s 5 keys act as your compliance and professional development foundations so you can map and self-audit your journey as a professional practice, to ensure you not only meet the regulatory rules: TCF, KYC, Suitability, MiFIDII, GDPR, SMCR but also benchmark against the FCA papers and good outcomes they covet and also track performance against your peers.

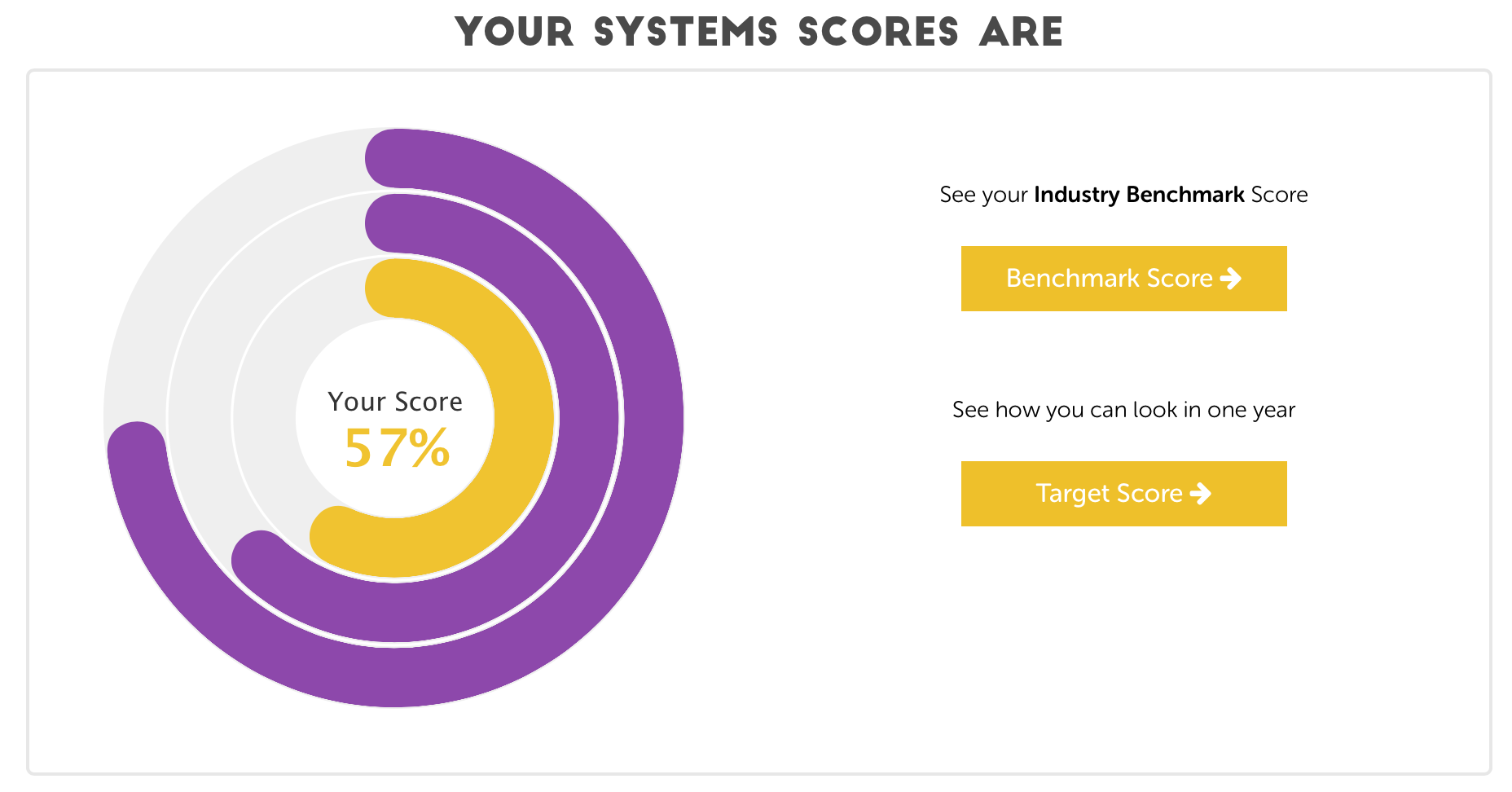

Operations and Data–Model Office-MO Key 4: Your Systems

[fa icon="calendar'] Nov 10, 2017 1:07:13 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, suitability, FAWG, FAMR, MiFIDII, Data, Systems and controls, Back Office

We now move to our 4th blog in our series on our #RegTech platform Model Office – MO and the 5 keys our research has found are crucial in building a compliant, client-centric and sustainable professional practice. Click here sign up for our weekly blogs.

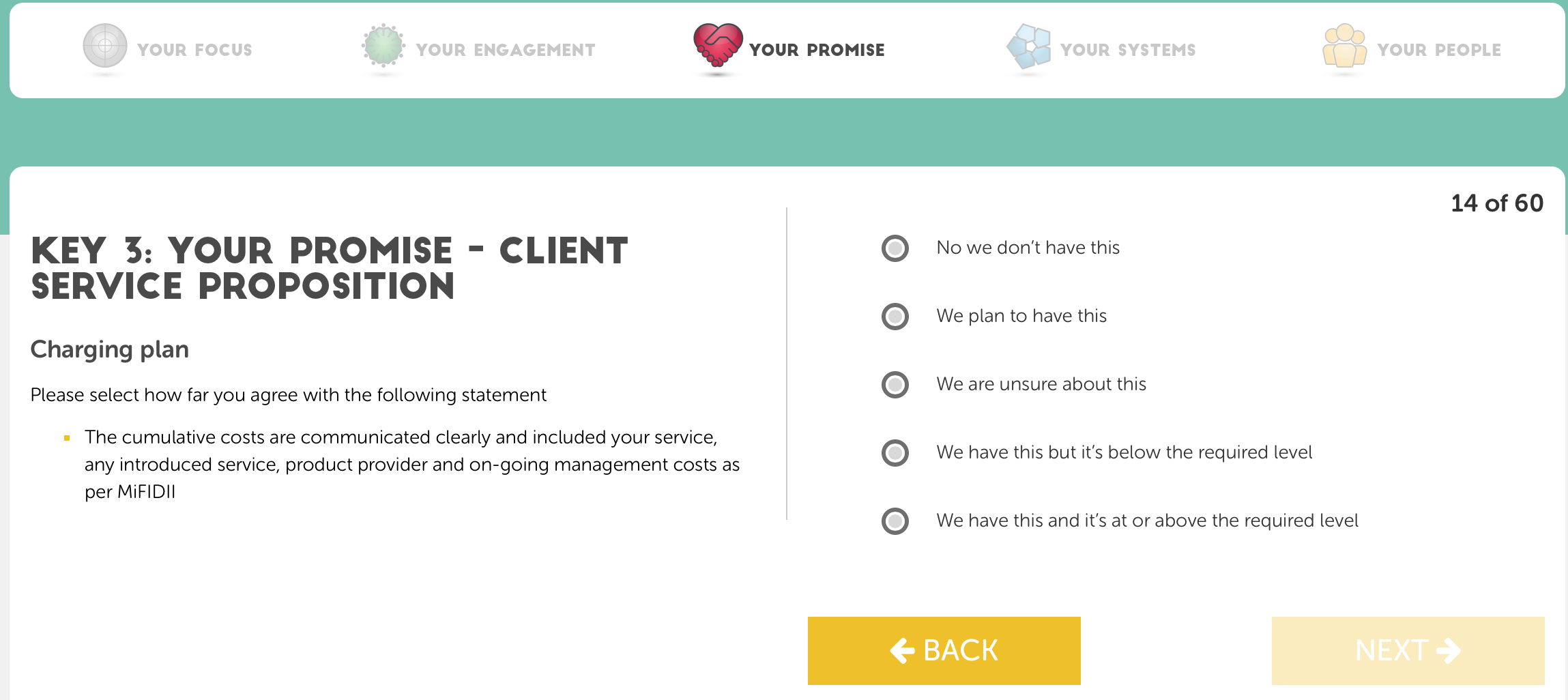

Meeting your commitments–Model Office-MO Key 3: Your Promise

[fa icon="calendar'] Nov 3, 2017 11:50:14 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, Data, CIP, Service Proposition

This is our 3rd blog across Model Office’s (MO’s) 5 keys and we now focus on your service proposition that MO classes as ‘Your Promise’ that you are making to meet your on-going clients needs.