As we embark on 2025, the UK financial landscape is poised for transformation, with the Financial Conduct Authority (FCA) leading the way. In this blog post, we'll delve into key regulatory topics proposed by the FCA for the year ahead. For an FCA view on their regulatory pipeline, you can view their Regulatory Initiatives Grid here.

2025 Regulatory Horizon Scan

[fa icon="calendar'] Jan 3, 2025 12:27:53 PM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source, Horizon scan

Christmas Magic: How AI is streamlining Compliance

[fa icon="calendar'] Dec 13, 2024 10:25:06 AM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source

As the festive season envelops us in tinsel and cheer, compliance officers in UK financial services are decking the halls with more than just holly. This year, they're unwrapping AI-powered tools that make regulatory compliance as smooth as a sleigh ride. Let's explore three innovative AI developments that are transforming compliance activities, all with a sprinkle of Christmas spirit.

The FCA's October 2024 Dear CEO letter: Directives for Financial Advisers: A Data-Driven Future

[fa icon="calendar'] Oct 7, 2024 3:32:25 PM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source

The Financial Conduct Authority (FCA) has issued its latest directives aimed at financial advisers and investment intermediaries, emphasising the importance of a proactive, data-driven approach to ensure regulatory compliance and deliver better outcomes for clients. This blog outlines the FCA’s Dear CEO letter priorities and how firms can adapt to meet these expectations effectively.

Ensuring Effective Oversight of Appointed Representatives: Key Compliance Insights for Principal Firms

[fa icon="calendar'] Sep 10, 2024 10:11:02 AM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source

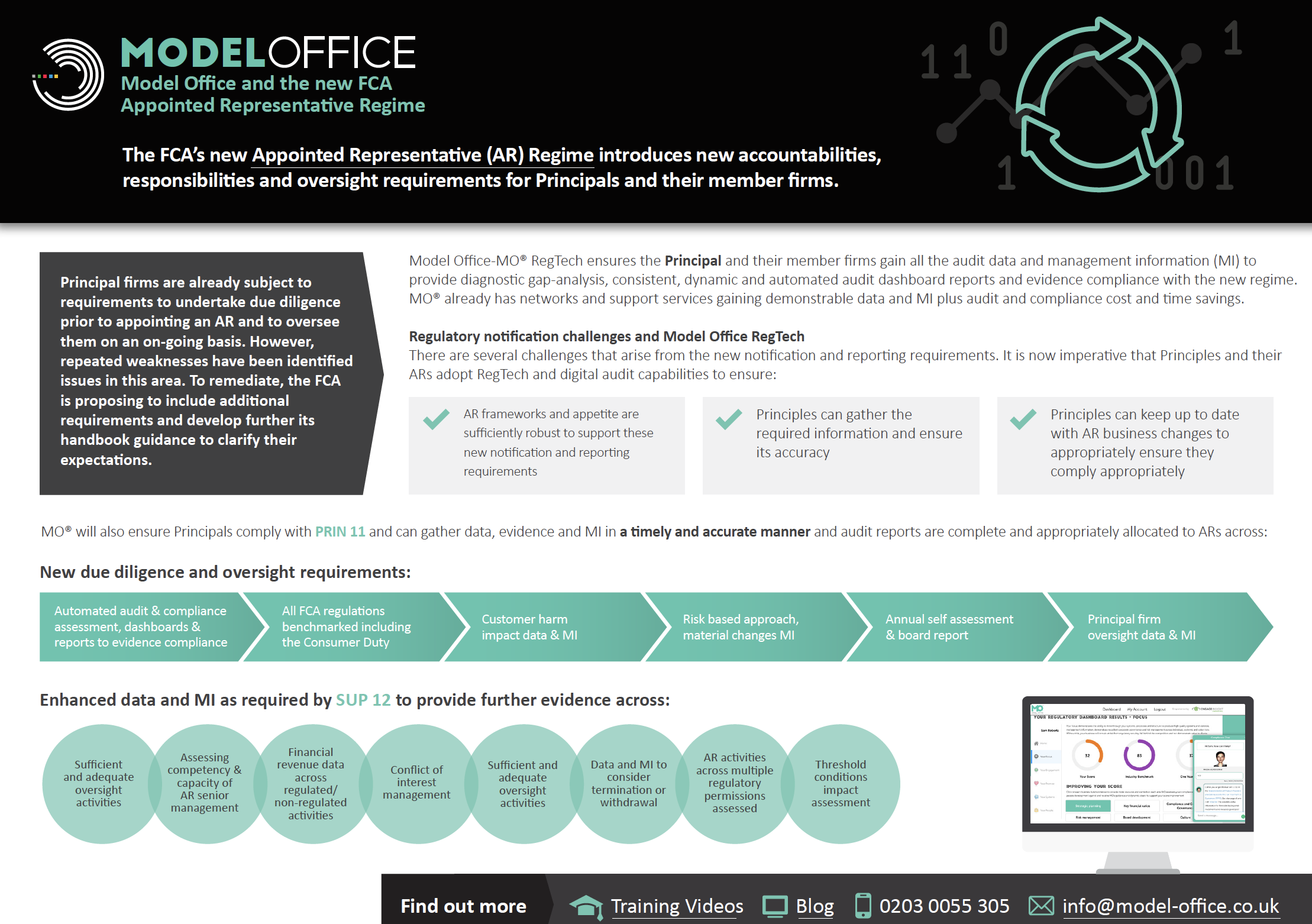

The Financial Conduct Authority (FCA) recently published new guidance on how principal firms should embed new rules to ensure effective oversight of Appointed Representatives (ARs). The updated regulations are designed to address risks in the AR regime, ensuring that consumers are adequately protected and that markets operate with integrity. Given the telephone interviews and questionnaires findings, that there are still significant gaps in oversight, the application for data led strategies and some principal firms are suffering from overconfidence in how well they are implementing these rules, it’s essential to understand these new requirements and how they impact the role of a principal firm.

Captain Scarlet and the Future of Regulation

[fa icon="calendar'] Jul 5, 2024 10:45:51 AM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source

We were fortunate to present to The Investment Network last week on the future of regulation, covering key themes retail financial advice firms need to factor into their governance, risk and compliance (GRC) activities, against a thematic backdrop of sci-fi films.

Apple's Gen AI Integration: A Game-Changer in Tech Dominance

[fa icon="calendar'] Jun 11, 2024 10:31:49 AM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source

Apple has taken a major leap in integrating artificial intelligence into its ecosystem with the upcoming iOS 18, iPadOS, and macOS updates. Here's a rundown of what you can expect:

The Open vs Closed Source AI Debate: Which is Right for Your Business?

[fa icon="calendar'] May 14, 2024 10:23:52 AM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, open-source, closed-source

In the ever-evolving landscape of artificial intelligence (AI), a critical distinction exists between open source and closed source AI. Whilst there is plenty of white noise regarding the pros and cons on AI and digital tools, understanding the open and closed source concepts is pivotal for developers, businesses, and enthusiasts aiming to leverage AI and digital strategies effectively.

The FCA Advice Boundary and AI

[fa icon="calendar'] Apr 23, 2024 4:04:50 PM / by Chris Davies posted in Financial regulation, client engagement, regtech, Risk management, practice management, FCA, advice, compliance, consumer duty, boundary

With the FCA stipulating that advice boundary review (along with the Consumer Duty) is its top priority for 2024, firm’s should now engage how tech can enable streamlined advice and support the mass unadvised. The FCA Discussion Paper 23/5 delves into the nuanced boundary between financial advice and guidance, raising pertinent questions about the application of artificial intelligence (AI) in navigating this complex terrain.

5 Regulatory challenges for 2022 and how RegTech can help

[fa icon="calendar'] Jan 5, 2022 3:45:00 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, MiFIDII, Data, GDPR, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice, GRC, governance, compliance, ESG, appointed representative, consumer duty

As we enter a new year, it provides us with an opportunity to review the past years activities and look ahead at what is to come. Indeed January is named after the Roman god Janus, who had two faces so he could see the past and future. What Janus may have told us from a regulatory perxpective.is the FCA are 'one one' with their future vision and learning from the past when it comes to firms regulation data and compliance analytics.

ESG: A green light for going green

[fa icon="calendar'] Nov 11, 2021 4:22:50 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, MiFIDII, Data, GDPR, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice, GRC, governance, compliance, ESG

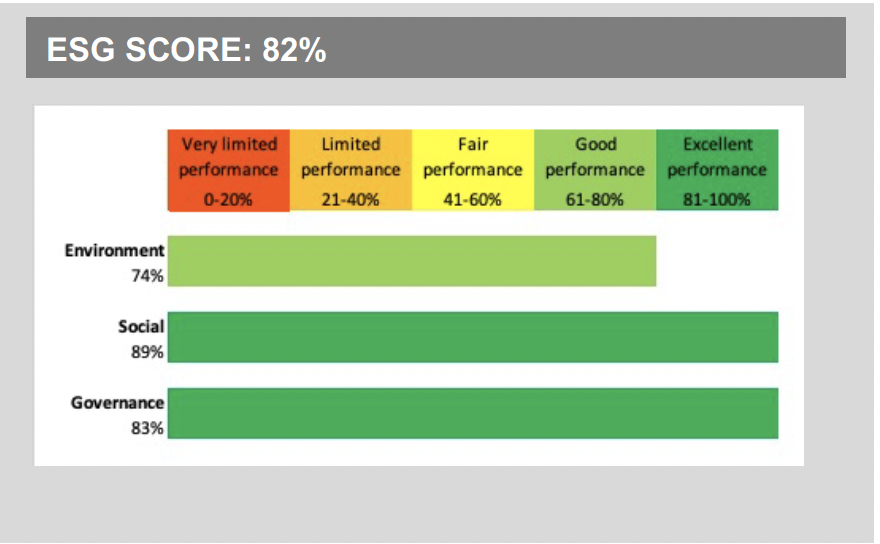

The ongoing focus on Environmental, Social and Governance (ESG) investment highlights the financial services industry's ongoing instrumental role in the transition to net-zero, through its ability to mobilise capital and engage with investors, companies and citizens.