We now move to our 4th blog in our series on our #RegTech platform Model Office – MO and the 5 keys our research has found are crucial in building a compliant, client-centric and sustainable professional practice. Click here sign up for our weekly blogs.

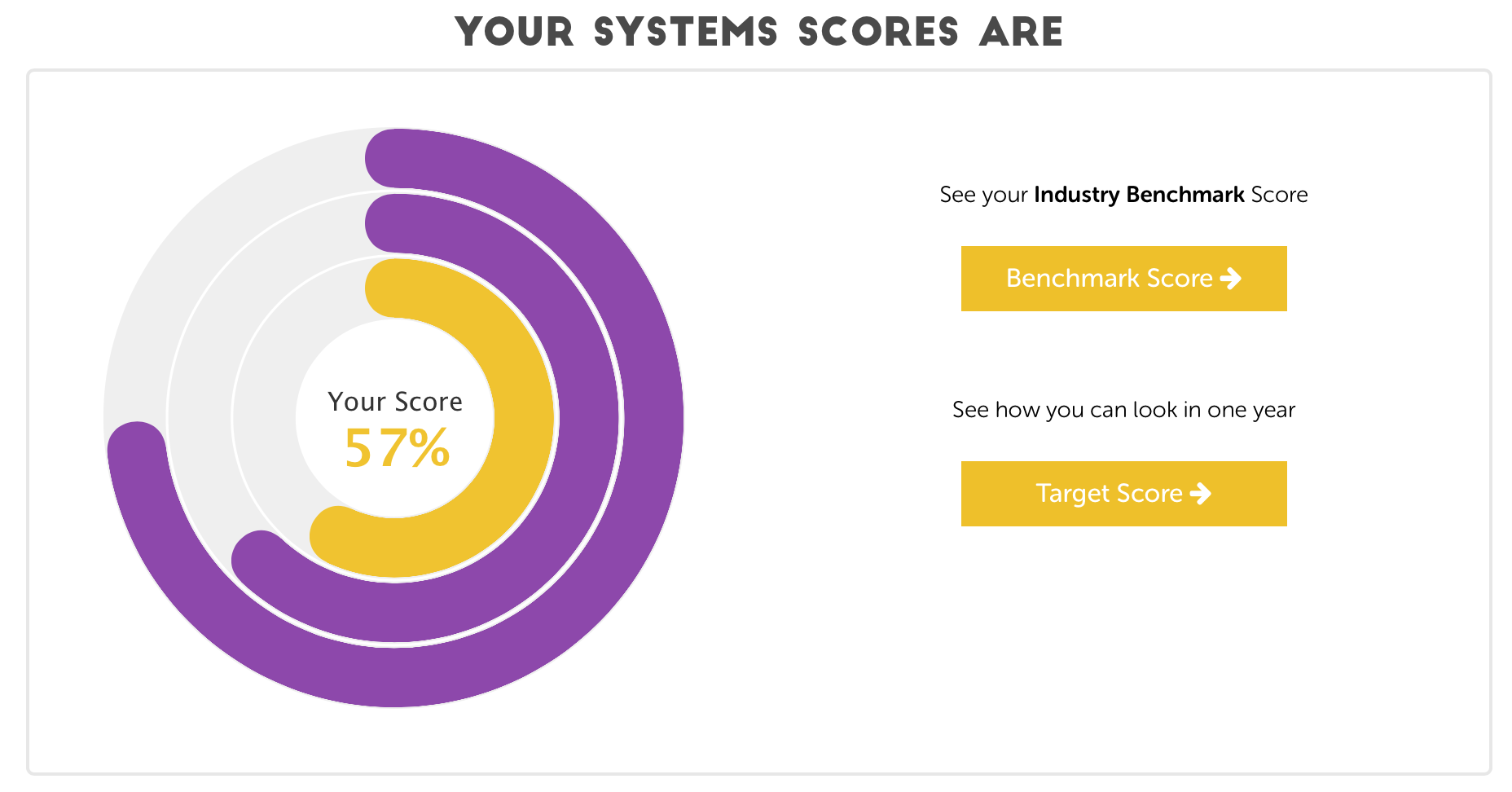

Operations and Data–Model Office-MO Key 4: Your Systems

[fa icon="calendar'] Nov 10, 2017 1:07:13 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, suitability, FAWG, FAMR, MiFIDII, Data, Systems and controls, Back Office

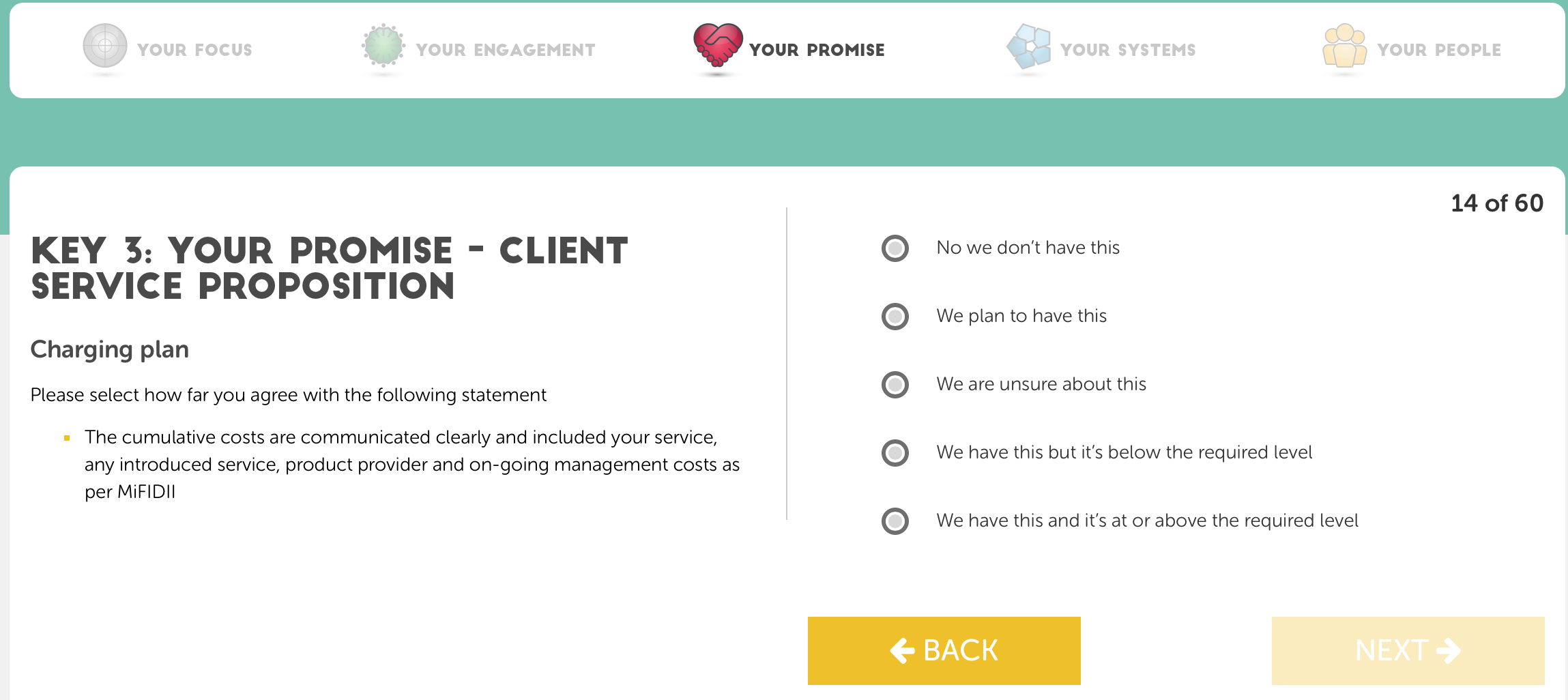

Meeting your commitments–Model Office-MO Key 3: Your Promise

[fa icon="calendar'] Nov 3, 2017 11:50:14 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, MiFIDII, Data, CIP, Service Proposition

This is our 3rd blog across Model Office’s (MO’s) 5 keys and we now focus on your service proposition that MO classes as ‘Your Promise’ that you are making to meet your on-going clients needs.

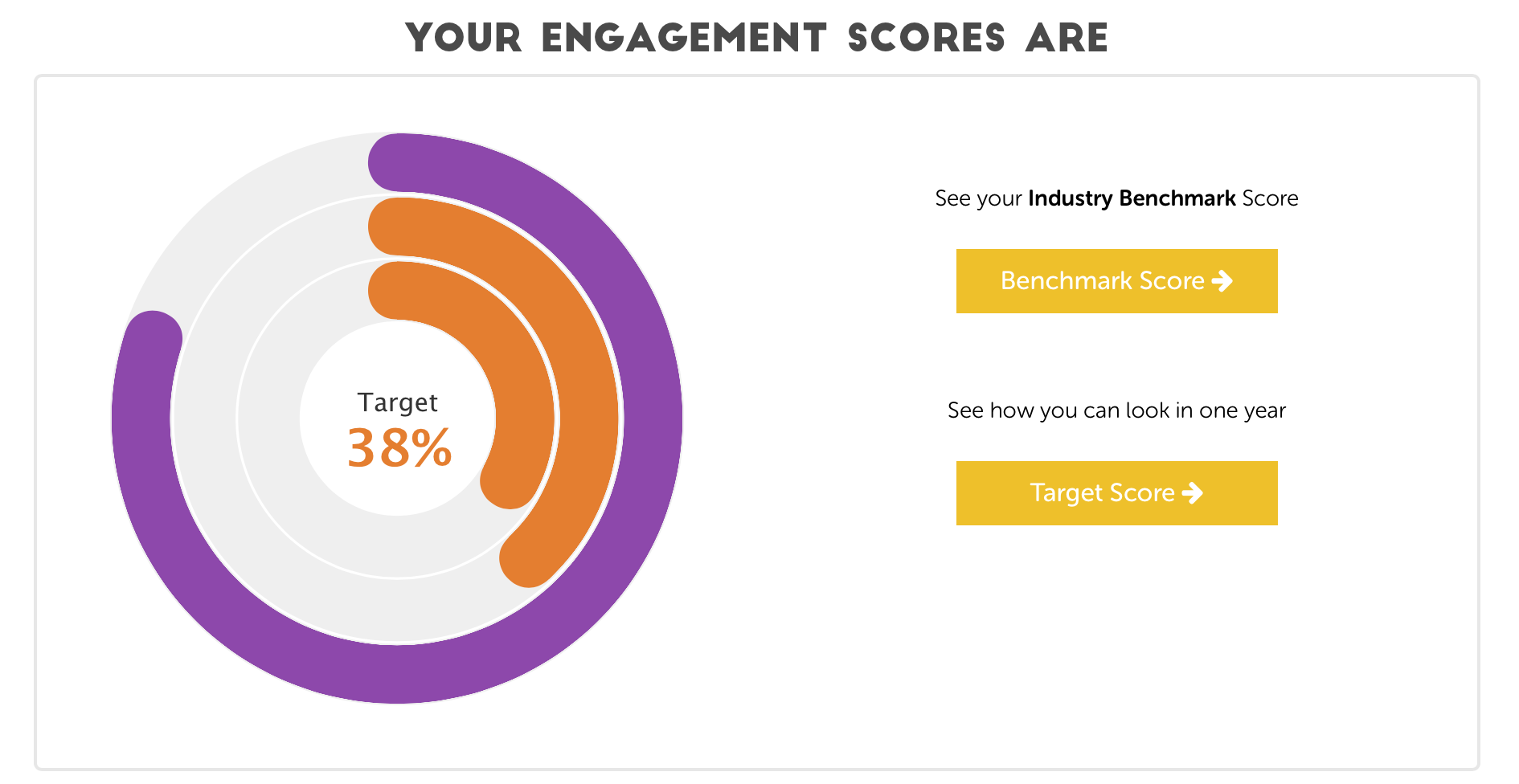

Taking Action–Model Office-MO Key 2: Your Engagement

[fa icon="calendar'] Oct 27, 2017 12:53:29 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR

In this suite of blogs we’re covering our digital compliance and business development platform Model Office (MO)’s 5 keys that form the foundations for MO’s #RegTech platform and ensures any retail investment adviser (RIA)/planner firm remain compliant, client-centric and sustainable in their professional development journey.

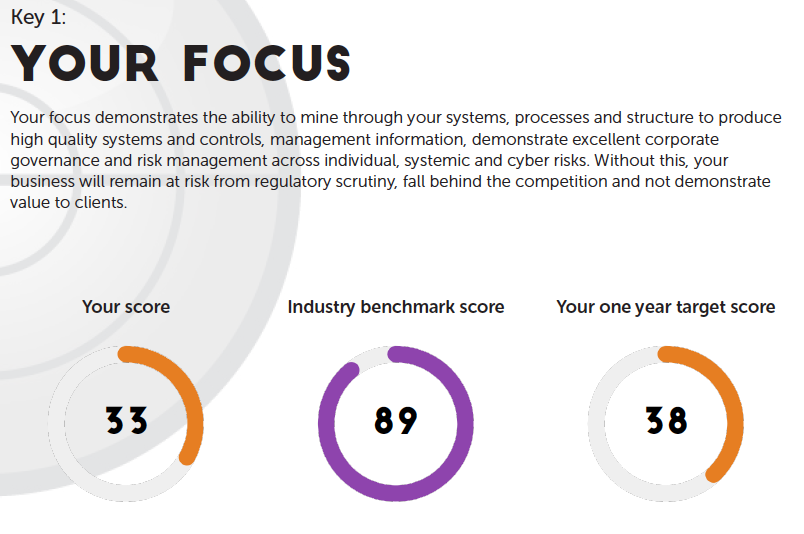

Taking aim – Model Office-MO Key 1: Your Focus

[fa icon="calendar'] Oct 20, 2017 12:43:52 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR

In this next suite of blogs we’re covering our digital compliance and business development platform Model Office (MO)’s 5 keys that form the foundations for MO’s #RegTech platform and ensures any retail investment adviser (RIA)/planner firm remain compliant, client-centric and sustainable in their professional development journey.

The General Data Protection Regulation -GDPR and your business

[fa icon="calendar'] Oct 5, 2017 10:11:59 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, Data, GDPR

The new EU General Data Protection Regulation (GDPR) in Europe, adopted in 2016, will be directly applicable starting on May 25, 2018. GDPR comes with significant changes compared to the Data Protection Directive 95/46/EC involving operational changes in organisations.

Building the case for constructive compliance

[fa icon="calendar'] Sep 21, 2017 3:58:00 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, SMCR

With The FCA now focusing on the implementation of MiFIDII plus with the SMCR and GDPR also on the way, we are now seeing far more focus on transparency, accountability, roles and responsibilities.

The Senior Managers and Certification Regime

[fa icon="calendar'] Sep 4, 2017 5:06:55 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII, SMCR

‘Culture and governance in financial services and its impact on consumer outcomes is a priority for the FCA. The extension of the Senior Managers and Certification Regime is key to driving forward culture change in firms.’ Jonathan Davidson Exec Director for Supervision for retail authorisations FCA.

Making sense of MiFID II with Model Office's #RegTech platform

[fa icon="calendar'] Jul 4, 2017 1:10:27 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, HMT, suitability, FAWG, FAMR, Fitbit, MiFIDII

Treating Customer’s Fairly on Speed? Well with the FCA final implementation rules upon us, the MiFID II requirements are intended to increase disclosure to clients, provide transparency around execution arrangements and order routing decisions, and should facilitate greater investor challenge and scrutiny by clients on the performance of firms acting on their behalf.

Model Office #RegTech platform Q2 question updates

[fa icon="calendar'] Jun 22, 2017 2:41:45 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, mifid, HMT, suitability, FAWG, FAMR, Fitbit

The FCA have been busy: there is the HMT/FAMR latest on definition of advice, the Suitability Review report, the latest on Defined Benefit Pension transfers. Elsewhere we have MiFID II implementation guidance, AML and General data Protection Regime - GDPR initiatives.

FCA, Suitability & Model Office #RegTech

[fa icon="calendar'] May 30, 2017 5:17:51 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, advice, mifid, HMT, suitability, FAWG, FAMR, Fitbit

The Financial Conduct Authority recently released Assessing Suitability Review looked into the suitability of the advice offered by the pensions and investment market, and the quality of disclosure in the sector.