Artificial Intelligence (AI) has come a long way in the past few decades. Today, AI is capable of performing a wide range of tasks, from recognizing objects in images and translating languages to playing games and driving cars. However, one of the most exciting and rapidly developing areas of AI is generative AI, which aims to create new content, rather than simply analysing or recognising existing content.

What is generative AI?

[fa icon="calendar'] Mar 8, 2023 8:47:11 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, AI, artificial intelligence

What's all the ChatGPT about?

[fa icon="calendar'] Feb 9, 2023 9:13:32 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA

As ever with Elon Musk, he creates plenty of noise with his ventures. Whether it’s sending cars into space, letting Trump back onto Twitter, Musk sets a certain tone across industries. So it is for Artificial Intelligence with his Open AI venture which launched ChatGPT3 in November 2022.

Foreseeable Harm, the key to Consumer Duty compliance

[fa icon="calendar'] Jan 10, 2023 12:13:20 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, consumer_duty

As market participants across the distribution chain now grapple with the next deadline (30th April ’23) for product manufacturers to have clear communications and information provided to adviser (distributor) firms for them to meet the Duty obligations, they should look to one of the cross-cutting rules to help them gain context for what the regulator requires when it comes to data and information for Consumer Duty compliance.

The Consumer Duty Final Countdown

[fa icon="calendar'] Sep 30, 2022 3:10:27 PM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, Consumerduty

With our research showing only 1 in 4 firms taking action on the Consumer Duty and a month to go until the first October 31st deadline, it is probably worth retail advice firm’s sense checking where they are and what they need to do to ensure they have plans in place to assess their competence against this all-encompassing regulatory framework.

The Consumer Duty Final Rules and your data

[fa icon="calendar'] Jul 27, 2022 9:35:47 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, consumer duty

So, the final rules are here and not much has really changed other than the implementation period has been extended slight for live business to July 31st, 2023, and closed book business has until 31st July 2024. Plus (wait for it) firms need to be up and running on their implementation by October ’22! Although any extension is welcome, it’s not long enough in my opinion given the ramifications this all-encompassing regulatory directive brings. Think Operational Resilience which has an implementation and transitional period totalling four years!

The FCA business plan 2022/23 and your data, data, data

[fa icon="calendar'] Apr 20, 2022 10:56:00 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, FCA, Analytics

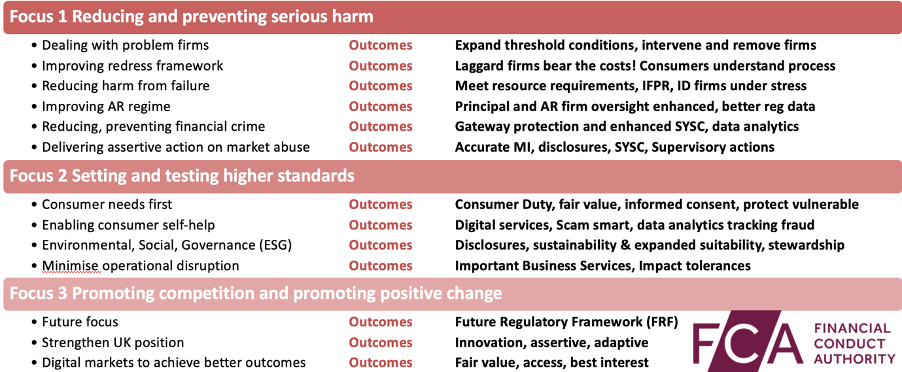

When they are not on strike, the FCA are producing promising work. Their new business plan and focus on metrics and outcomes is a case in point. This business plan takes a new form in that it is hosted digitally on a webpage which provides hyperlinks to other relevant resources such as their three-year strategy and excellent Regulatory Initiatives Grid.

Improving the Appointed Representatives Regime Consultation Paper CP21/34 and the need for #RegTech

[fa icon="calendar'] Jan 21, 2022 10:02:22 AM / by Chris Davies posted in Benchmark, compliance, client centric, Financial regulation, Financial business development, fintech, Human resource development, client engagement, regtech, Constructive compliance, Risk management, practice management, FCA, appointedrepresentatives

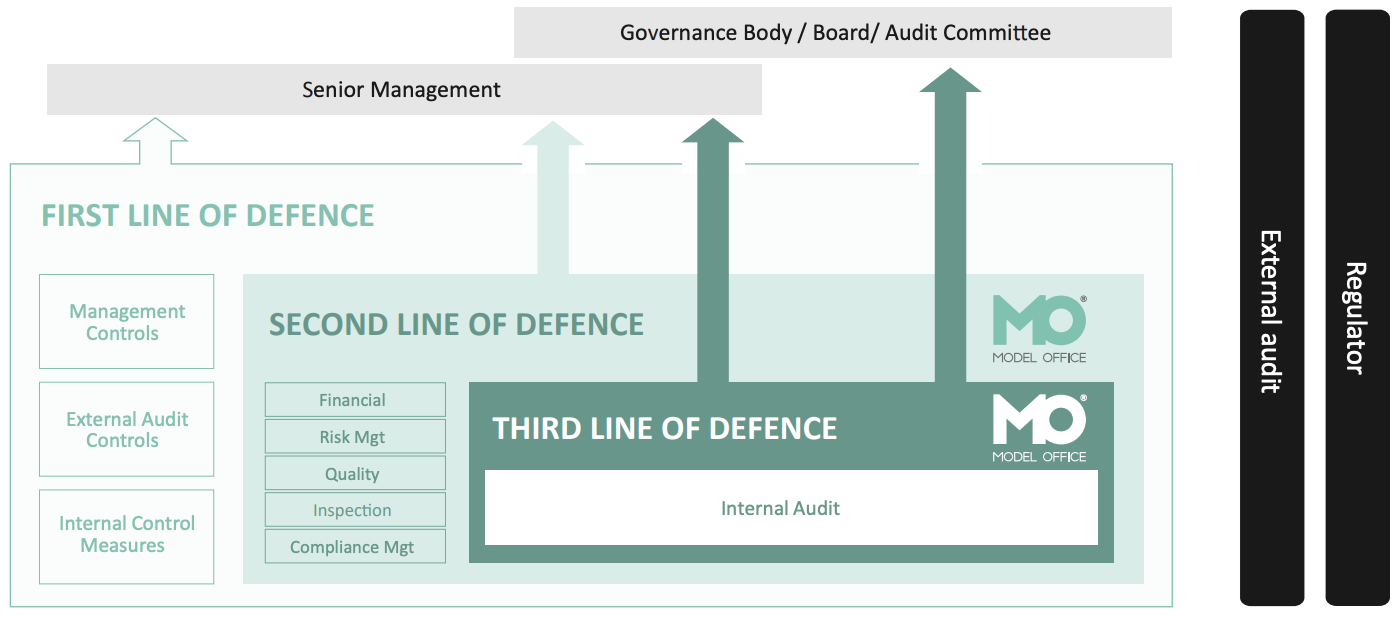

With the latest FCA consultation paper for improving regulatory oversight of the Appointed Representative Regime, without a cohesive, coordinated approach, Principle firms governance, risk and compliance (GRC) systems and control audit resources may not be deployed effectively and significant risks maybe missed. This can lead to mis communications and dysfunctions within the Principal firm internal GRC practice, poor reporting, market risk and poor consumer outcomes across AR activities. With the FCA’s new proposals, based on a background of poor consumer outcomes at the hands of ARs, Principals and their ARs now need to employ RegTech to gain clear and accurate data analytics across all activities to ensure they comply in order they can continue to compete. This blog looks at the key themes and how RegTech can support Principal firms and their ARs.

5 Regulatory challenges for 2022 and how RegTech can help

[fa icon="calendar'] Jan 5, 2022 3:45:00 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, MiFIDII, Data, GDPR, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice, GRC, governance, compliance, ESG, appointed representative, consumer duty

As we enter a new year, it provides us with an opportunity to review the past years activities and look ahead at what is to come. Indeed January is named after the Roman god Janus, who had two faces so he could see the past and future. What Janus may have told us from a regulatory perxpective.is the FCA are 'one one' with their future vision and learning from the past when it comes to firms regulation data and compliance analytics.

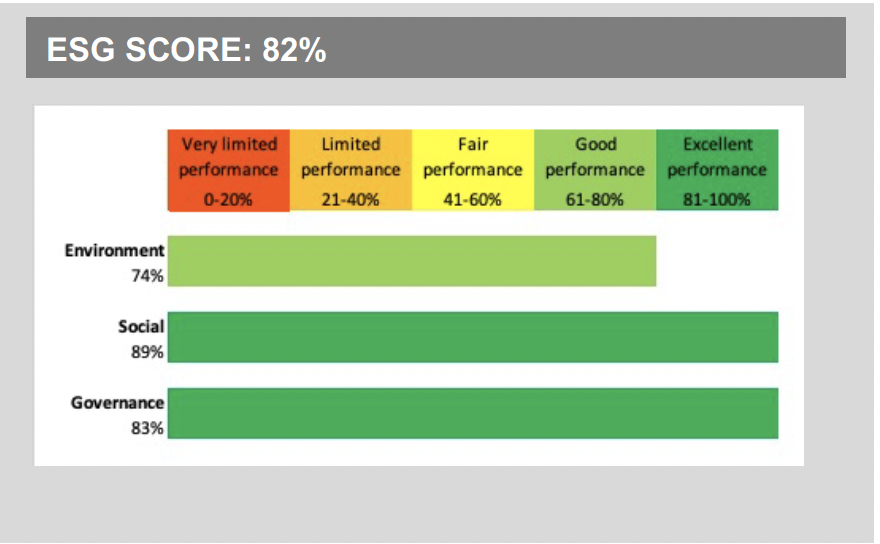

ESG: A green light for going green

[fa icon="calendar'] Nov 11, 2021 4:22:50 PM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, MiFIDII, Data, GDPR, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice, GRC, governance, compliance, ESG

The ongoing focus on Environmental, Social and Governance (ESG) investment highlights the financial services industry's ongoing instrumental role in the transition to net-zero, through its ability to mobilise capital and engage with investors, companies and citizens.

Does Artificial Intelligence (AI) really exist in retail financial services? Discuss

[fa icon="calendar'] Sep 17, 2021 9:17:49 AM / by Chris Davies posted in Financial regulation, Financial business development, fintech, regtech, Risk management, practice management, FCA, advice, HMT, suitability, Data, GDPR, Culture, Enforcement, supervision, audit, Conduct, auto advice, streamlined advice, AI, GRC, governance, compliance

This is a topic that often comes up across social media and conferences that focus on FinTech developments within retail financial services industry. There is no doubt with the fast growing digital ‘fourth revolution’, we are witnessing rapid build and deployment of tech throughout industry products and services.